What happens

to House Prices during Stagflation?

The relationship between house prices and stagflation is somewhat confused by the workings of two opposing forces. On the one hand, stagflation brings rising prices due to supply-side pressures in the economy. On the other hand, the rising price level will bring higher interest rates, making mortgage costs more expensive for potential homebuyers.

The higher costs will reduce demand for housing, thereby putting downward pressure on house prices. Additionally, while many existing homeowners may have fixed interest rate mortgages, the stagnant economic growth and high unemployment that characterizes a period of stagflation will mean reduced disposable income, making it difficult for those homeowners to meet their existing mortgage payments.

This can lead to an increase in mortgage defaults and foreclosures, putting further downward pressure on house prices.

Whether or not nominal house prices will fall during a period of stagflation is uncertain, but the inflation adjusted value of houses will likely fall, because consumers will likely shift their spending habits towards a more cautionary stance. Spending on basic necessities will take precedence, and while shelter is a basic necessity, a bigger house is not.

House prices, as with other asset prices like stocks and shares, are pro-cyclical. This means that they tend to rise relatively faster when the economy is doing well, and fall faster when it is doing poorly.

However, stagflation is a unique type of economic hardship where prices are rising. Rising house prices can lead to a flurry of homebuying as people experience FOMO i.e., fear of missing out. If this happens, combined with supportive government policies, the demand for housing can rise even as costs soar.

The question is, which of these influences will dominate?

Interest

Rates and House Prices

During stagflation, high inflation erodes the purchasing power of the currency, and central banks like the Federal Reserve typically respond to that by raising interest rates. Monetary policy becomes contractionary in order to reduce the number of monetary units circulating in the economy. As that happens, each remaining monetary unit gains purchasing power, thereby reducing inflation.

The effects of higher interest rates are felt more in some markets than others, because interest rates represent the cost of borrowing money. Mortgage costs are directly affected by interest rates, and so stagflation usually leads to strong downward pressure on house prices. At the same time, higher unemployment rates can result in decreased demand for housing as individuals start to delay homeownership due to financial insecurity.

Remember that, during stagflation, most prices are rising. That being the case, the downward pressure of house prices might not result in falling nominal prices. It might just lead to relatively slower price rises. Real prices i.e., inflation adjusted prices, might be lower even if nominal prices rise somewhat.

Historical

example of stagflation and its effect on house prices

One notable period of stagflation occurred in the 1970s, following the OPEC oil crisis that occurred at that time. The global economy experienced a significant increase in oil prices, leading to higher costs of production and higher inflation with stagnant economic growth as a result.

The housing market in the United States was not immune to these effects. House prices stagnated and, in some areas, experienced significant declines. The combination of high inflation and high interest rates made it challenging for individuals to afford housing, leading to decreased demand and downward pressure on house prices.

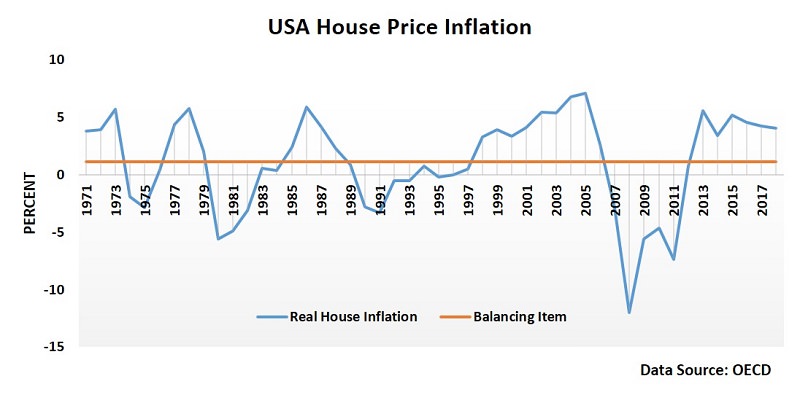

In the graph above, US real house price inflation (adjusted for general long-term house price inflation) turned negative in the mid-1970s and late-1970s as the oil crisis (along with other negative cyclical forces) took its toll on the economy and created stagflation.

Of course, it is still possible for FOMO to dominate interest rate rises and declining purchasing power. Much depends on the state of the housing market as it enters a period of stagflation. If it is undervalued going in, it may still be affordable enough that FOMO dominates, allowing house prices to quickly rise.

Factors

influencing house prices during stagflation

The following main factors influence house prices during stagflation:

- Inflation – The inflation rate plays a crucial role in determining the purchasing power of individuals and their ability to afford housing. High inflation can erode the value of money, making housing less affordable and putting downward pressure on house prices.

- Interest Rates – During stagflation, central banks may respond to high inflation by raising interest rates. Higher interest rates can make borrowing more expensive, reducing the affordability of housing and potentially decreasing demand, leading to lower house prices.

- Unemployment – High unemployment can impact the housing market by reducing demand for housing. Individuals who are unemployed or have uncertain job prospects may delay homeownership, leading to decreased demand and a potential decline in house prices.

- Supply & Demand – If the supply of housing exceeds demand, prices may decline. Conversely, if demand outpaces supply due to FOMO, house prices may rise.

- Government Policies – Government programs that incentivize homeownership, or provide mortgage assistance, can help support house prices.

- Investor Sentiment – If investors perceive the housing market to be at risk due to stagflation, they may reduce their investments, potentially exerting downward pressure on prices. If they perceive that FOMO is dominant, they may increase their investments and stimulate price rises.

Case studies:

Examining case studies of how different countries have dealt with stagflation and its effect on house prices can provide valuable insights into potential strategies and outcomes.

- During the stagflation of the 1970s, the United States implemented various measures to combat high inflation and stimulate economic growth. The Federal Reserve raised interest rates to curb inflation, which had a dampening effect on the housing market. However, the introduction of government programs such as the Community Reinvestment Act helped support housing affordability and stabilize house prices in certain areas.

- The United Kingdom experienced severe stagflation in the 1970s and early 1980s. The government implemented policies aimed at reducing inflation and stimulating economic growth. These measures, combined with tight monetary policy, led to a decline in house prices. However, government interventions such as the introduction of right-to-buy schemes supported homeownership and helped stabilize the housing market in the long run.

- Japan experienced a prolonged period of stagflation in the 1990s, commonly referred to as the "Lost Decade." High inflation, stagnant economic growth, and a burst property bubble had a significant impact on house prices. The government implemented various measures to address these challenges, including monetary easing and fiscal stimulus. However, it took several years for the housing market to recover, highlighting the long-term effects of stagflation on house prices.

These case studies demonstrate the diverse approaches taken by different countries to address stagflation and its impact on house prices. It is essential to consider the unique economic and policy dynamics of each country when assessing potential strategies and outcomes.

Conclusion: What happens to house prices during stagflation?

Stagflation, characterized by stagnant economic growth, high inflation, and high unemployment, can have a profound influence on the housing market. Understanding the relationship between stagflation and house prices, historical examples, and the factors influencing house prices during stagflation are critical in any particular set of circumstances.

As a general rule, as evidenced by past examples, stagflation will have a negative impact on house prices. Cases where house prices rose faster than other prices in the economy are tough to find during these periods, but each case needs to be examined on its own merits.

Sources:

Related Pages: