- Home

- Monetary Policy

Monetary Policy & Theory Explained

Over the past one hundred years, appropriate monetary policy has been at the epicenter of economic theory controversy. For most of our economic history, our money had been somewhat free of direct control by government or its institutions, and interest rates were determined by market forces.

Money itself had real intrinsic value, unlike the fiat currencies that are now in operation. Access to credit depended on someone else providing loanable funds through their savings. However, all this changed with the advent of modern fractional reserve banking, and fiat currency, both of which would come to be be managed by a central bank via its interest rate policy.

A big part of the problem with the fractional reserve banking system is the unfounded confidence that is placed on central banks such as the Federal Reserve (or on governments directly) to manage the boom-and-bust cycle via effective monetary policy, i.e., by managing a monetary aggregate target such as M2 via interest rate policy.

History to date has provided little to no evidence of any central bank having the competence or the will to act in such a way that the business cycle is smoothed out.

Now, I do understand the claim that an interest rate hike ahead of a boom will pull money out of the economy, reducing the monetary base and making credit for mortgages and other loans either completely unavailable to some people, or if available then only at significantly lower amounts. But this claim includes three serious errors:

- It assumes that the Federal Reserve significantly reduces the total money supply by raising interest rates at just the right moment to mitigate any overheating.

- It assumes that demand for credit is interest rate sensitive, which it isn't at times when the housing market is overheating and buyers are desperate to get on the property ladder before they are priced out of the market altogether.

- It underestimates the ability of the modern fractional reserve system to create money regardless of the central bank.

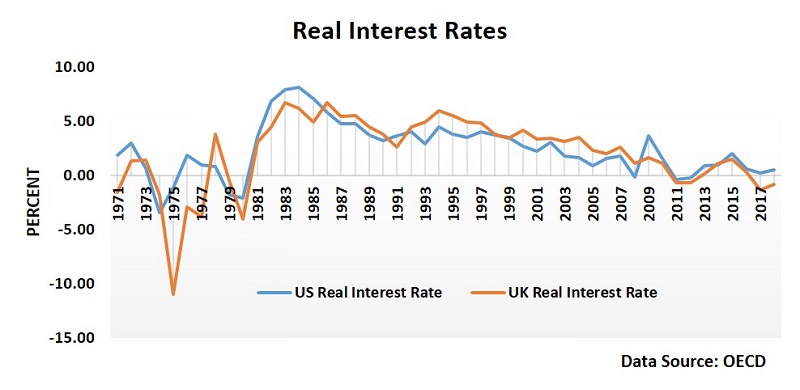

On the first point, you might be very surprised to discover that real interest rates (nominal rates minus the CPI inflation rate) have actually been gradually lowered in the US, the UK, and most of the developed world since the 1980s.

There is very little evidence in the data of any kind of proactive attempts by a central bank to cool down its economy ahead of a boom-bust cycle by significantly raising interest rates, monetary policy has been extremely loose for decades, and always reactive rather than proactive.

Real Interest Rates

If interest rates were pushed higher in an attempt to cool the economy down, it would be politically unpopular. Because of this, governments and their so-called 'independent' central banks, typically prefer to boost their way out of a recession only after their economies have already sunk into one.

They do this by lowering interest rates and/or printing money, which can be seen in the graph above with lower rates during the recession periods of the mid 70s, early 80s and early 90s. By the time of the 2008 financial crisis, nominal interest rates were already so low that lowering them further was not feasible. Money printing, i.e. quantitative easing, therefore became the favored option at that time.

Unfortunately, these lower interest rates and money-printing tactics are a little like trying to force the economy to continue producing at an overheated level regardless of it causing ever-growing national debt levels and ever-growing trade deficits i.e., this implies living beyond our means, and the Federal Reserve seemed intent on keeping it that way right until rapidly rising inflation presented itself in 2022.

Moreover, the attempt to increase bank lending (and thus spending) by lowering interest rates might even fail if the credit market is supply driven i.e., if it causes banks to reduce their lending due to low profitability from low interest rates. The Federal Reserve tends to think credit creation is purely demand driven with high street banks willing to play along at any interest rate, but recent experiences since 2008 paint a different picture, with the US and UK both experiencing a liquidity trap problem.

On the third point above, regarding the money supply, the prospect of huge banking sector profits during a property market boom have proven to be an enticement too powerful to resist. The retail banking sector usually reacts by lowering its reserve ratio (increasing the money multiplier), and loosening their risk assessments enough to approve these extra mortgage loans, and thereby expand credit (boosting the money supply) in the economy.

In other words, the retail banking sector can massively increase or decrease the money supply independently of central bank money (or base money as it is called).

What is particularly disgusting is the fact that they do this in the secure knowledge that, if the worst comes to the worst, they can walk away with a government bailout to solve any potential balance-sheet difficulties. In other words, they gamble with other people's money and collect any winnings for themselves whilst letting regular people pay the costs if they fail.

Housing Market Booms & Busts

The main thrust of the Austrian Business Cycle Theory is that the boom & bust nature of the economy is either caused by, or worsened by, the excessive money creation of the fractional reserve banking system, because interest rates end up being much lower than their market clearing rate.

The accusation is based on the fact that there is no automatic stabilization of credit booms via free-market rationing of credit. New credit and money lending will occur without any extra saving to offset inflationary pressures. This usually results in an unsustainable boom in spending, and an accompanying bust sometime later.

For example, when an economy starts to overheat i.e., when spending levels start to exceed productive capacity, this will most easily be seen in the housing market. This is because better housing is one of the first things that people want when the economy is growing, and none of it can be produced overseas - housebuilding is entirely a domestic industry.

When an economy overheats, it is domestic industries that experience inflation.

A short-run increase in consumption of imported goods does not cause inflation or overheating at all, because the world economy has massive spare capacity with which to increase production and satisfy any extra domestic demand.

The domestic economy, on the other hand, can only increase production at a manageable rate. Unfortunately, that rate is slower than required in a system that creates excess spending via practically limitless credit booms. To see how well the housing market predicts overheating in an economy, see the UK & USA examples below.

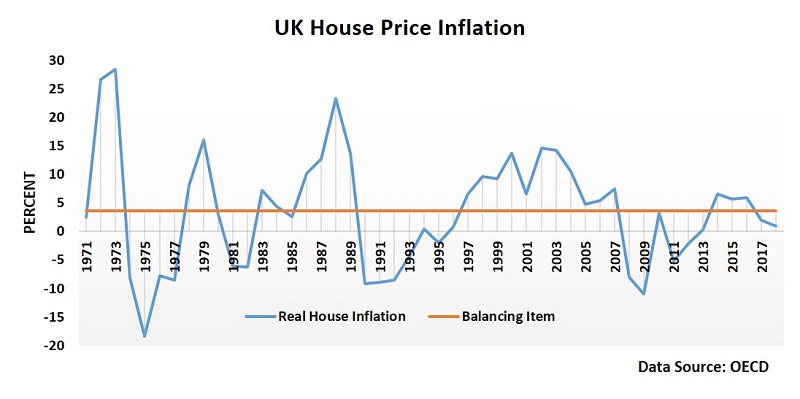

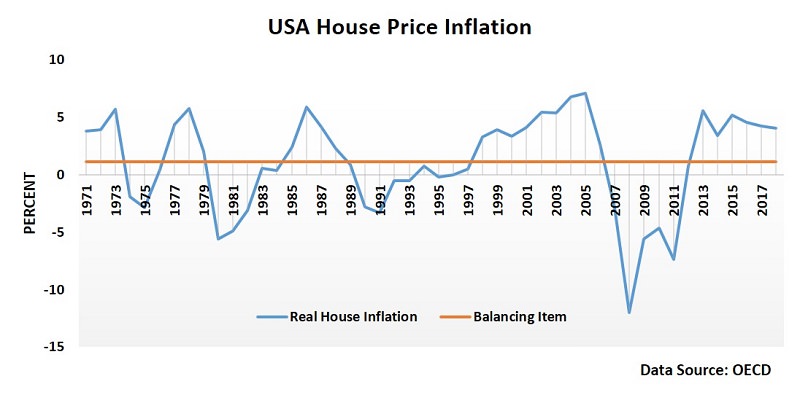

In the graphs below, the blue lines show the real inflation rate of housing i.e. house price inflation minus general CPI inflation. The flat orange lines show the average house price inflation over the period, and act as balancing items to show when house prices are rising faster/slower than the long run average.

The Business Cycle in the UK

Since the beginning of the 1970s until 2018, the UK has experienced 4 main recessions i.e. the mid 70s, early 80s, early 90s, and the 2008 financial collapse. The graph below shows how inflation in the housing market has always exceeded its long run rate in the years prior to these recessions.

There were, of course, many other specific factors that influenced the boom & bust cycle during these recessions e.g. oil price rises in the 1970s, the dot.com Asian financial crisis, membership of the ERM (which forced an artificially high exchange rate) and so on. However, it's quite clear that the housing market is a good estimator of credit levels in an economy (due to people borrowing for mortgages, extra furniture, decorating costs, legal fees, landscaping and so on).

The Business Cycle in the USA

Almost exactly the same pattern is evident in the USA where the major recessions of the period were also in the mid-70s, early 80s, early 90s, and the 2008 financial crisis.

The particular influences on the US economy during the period were similar in some respects to those which affected the UK, and completely different in other respects, but through it all the credit booms initiating an overheating housing market predicted all these recessions.

It would seem to be an uneasy balance of incompetence and negligence that has led our governments to discard the predictive power of the housing market with regard to the business cycle, but at the same time I recognize that there's little anyone can do to prevent these money-multiplier induced booms under our current banking system.

Monetary Theory

As with so many topics in economics, monetary theory has developed along Keynesian and Classical lines depending on whether the preferred focus is on the short-run (Keynesian) perspective of the long-run Classical model.

The Monetarist School, and especially Milton Friedman, has also been extremely influential in recent decades. However, experiments in monetarism in the 1980s were not entirely successful due to its focus at the time on controlling specific monetary aggregates. Any such attempt at controlling an aggregate soon proved futile as predicted by 'Goodhart's Law'.

For specific articles on monetary policy and theory, as well as other related pages, see the links below.

Related Pages: