- Home

- Consumers

Consumer Behavior Theory & Examples

Understanding consumer behavior, or at least the fundamentals of what drives complex choices by consumers in the marketplace, lies at the heart of microeconomics. Along with an understanding of producers and their motives, consumer behavior theory forms the core of research into this branch of economic science.

Modeling how consumers will react to new products, or existing products at different price points, allows firms to build an idea of where to focus their resources. Those firms that can best satisfy the demands of consumers in an ever-changing marketplace will be the most successful and make the most profit.

The symbiotic relationship between consumers and producers helps to ensure that optimal outcomes for both are achieved given budget constraints and scarce resources.

Why study Consumer Behavior?

Studying consumer behavior is, believe it or not, quite enjoyable. Where much of economics is mired in controversy and disagreement, the theory here is more or less universally accepted by all economists whether they belong to the Keynesian, Monetarist, Neoclassical, Austrian or some other camp.

In fact, the value of really mastering the ideas here cannot be overstated for any serious aspiring economist, because they underpin most other ideas in the entire subject area of economics. In essence, there are three components to consumer behavior research and modeling i.e., consumer preferences, budget constraints, and consumer choice.

Consumer Preferences

When talking about consumer preferences, economists are referring to the combinations (also called bundles or baskets) of goods that people choose to spend their money on. Logically we can assume that the typical consumer will seek to maximize his/her satisfaction with the particular bundle of goods purchased, because money is valuable and limited. When we give up money, we want to extract as much value (usually called 'utility') from it as possible.

In a similar manner to observing how a given consumer chooses to optimize his/her utility by choosing preferred goods over others for a given expenditure, we can also deduce preferences by offering different fixed bundles of goods and services to all consumers, and then observing which of those fixed bundles are most desirable. Firms do this all the time when they introduce new products to the market e.g. when a new games console is released and is offered with control pads, a few games, and various other items as a package deal.

Consumer preferences are assumed to be:

- Complete - in other words consumers will prefer one bundle over another, or they will be indifferent between the two depending on the utility that they derive from them. Note that this is independent of the cost of each bundle i.e. if the price of each bundle is equal then consumers will choose the bundle that gives them the most satisfaction.

- Transitive - simply meaning that if bundle A is preferred to bundle B, and bundle B is preferred to bundle C, then we deduce logically that bundle A is preferred to bundle C. Note that this simplifying assumption may not always hold e.g. in a rock, paper, scissors game the rock is preferred to the scissors, scissors are preferred to paper, but we would be mistaken to assume that the rock is preferable to the paper.

- Non-Satiation i.e. More is better - we assume that if some goods offer us utility then more goods will offer us more utility. Again this is merely a simplifying assumption, and we acknowledge that it does not always hold. E.g., if one ice cream is good, two may well be better, but at some point more and more ice cream will not be better, and it can even give us negative utility by making us feel sick.

We shouldn't be overly concerned by the imperfections of the three assumptions that underpin consumer preferences because no model is judged on whether or not it is perfect. Almost by definition a model will give a flawed and incomplete picture of reality, but that doesn't mean that they are useless. Models of consumers and the behavior in the market are actually very useful, and they do allow useful analysis to be done.

The concept of consumer indifference between differing bundles of goods is a particularly important one that requires further explanation; I've provided this in my article about:

Budget Constraints

Naturally, a great deal of the behavior exhibited by consumers in the market for goods and services is limited by their budget constraints. We may desire more products, but we have limited incomes with which to purchase those products. Demand is defined by both the desire and the means to purchase things, desire alone does not determine the level of demand in the economy.

Our budget constraint is added to our model of consumer buying behavior to add realism, and for specific details about this, have a look at my page about:

In the next section I will assume prior understanding of the budget line and of indifference curves, so it might be an idea to click through the links above for an overview/refresher on those concepts.

Consumer Choice

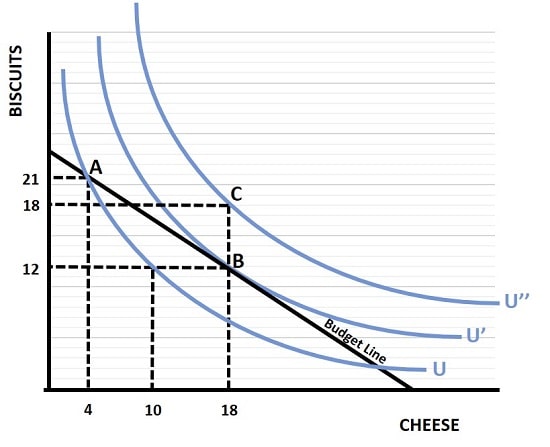

The graph below brings together the most fundamental concepts of consumer choice given preferences and limited incomes. I've chosen to represent these concepts with the two-good model due to its simplicity; there are of course a vast number of products that consumers choose from, but the principles of choice are identical. For my model, the two goods that consumers decide between are servings of biscuits, and servings of cheese.

Let's consider three alternative combinations (or baskets) of these goods i.e., A, B and C. With basket A, the consumer chooses 21 servings of biscuits and 4 servings of cheese. We know that this exhausts the consumer's budget because basket A sits on the budget line. However, basket A does not maximize the consumers level of satisfaction - why? Because basket A does not sit on the highest affordable indifference curve.

Each indifference curve represents a fixed level of utility (or satisfaction), and only those bundles of biscuits and cheese that sit on the highest indifference curve that the consumer can afford will offer the maximum level of utility.

With basket B all of the requirements for maximum utility are met. With 12 servings of biscuits and 18 servings of cheese, the consumer's limited income is spent at this point since it also sits on the budget line, and only at this point does it also sit on the highest affordable indifference curve. All other points on this curve are located above the budget line and are therefore unaffordable.

If the consumer had enough income, he/she would prefer to consume basket C over basket B, with 18 servings of both biscuits and cheese, but this is not possible because basket C is located above the budget line, making it unaffordable.

Note that the utility maximization point occurs where the budget line is tangential to the highest attainable indifference curve. The tradeoff between how many servings of biscuits the consumer is willing to sacrifice in order to obtain an extra serving of cheese is also illustrated by the slope of the indifference curve at various tradeoff points, and this tradeoff is known as the marginal rate of substitution (MRS). At the utility maximizing point, the slope of the budget line and the MRS are usually, but not necessarily, equal.

The slope of the MRS line is always equal to the negative ratio of the price (not the quantity) of the good on the horizontal axis divided by the price of the good on the vertical axis. (It's a negative because the MRS line slopes down i.e. as the quantity of one goods increases, the other decreases, giving the negative relationship).

MRS = -Ph/Pv

In words, this just means that the MRS is equal to the negative of the price of the good on the horizontal axis divided by the price of the good on the vertical axis. It's quite common for the ratio to be expressed without the negative sign, because it is often simply assumed. For details on the MRS, check out my article:

Consumer Behavior Data

Companies gather data about the customers all the time in the real world and the insights that come from marketing campaigns and all manner of product research exercises all come together to build up as accurate a picture as possible about how consumers decide to purchase one good over another.

Building up a profile of a typical customer, what their preferences are, how they value products, and how they interact with related products all helps to improve the customer experience, which in turn improves customer retention rates i.e., repeat customers. Segmentation techniques are often applied to marketing campaigns in order to model how different groups of customers interact with different products.

For example, customers can be segmented according to age, sex, where they live, how they discovered your store/product and so on. Data can be gathered in-store, via online surveys, via professional marketing research consultants, telephone surveys, and many other ways.

Marketing campaigns are carefully constructed to make full use of all this data, in order to optimize the entire customer journey from casual browser, to interested potential buyer, to full sales conversion.

How do firms influence consumer behavior?

The whole purpose of marketing is to affect the way that consumers behave, and to do so in a way that leads to greater profits for companies. This isn't always aimed directly at increasing sales, for some products there is a whole industry aimed at generating leads that may eventually turn into sales at some point in future.

Another way that firms influence consumers is via advertising campaigns that build brand recognition, then there is the tactic of providing social proofing whereby favorable customer feedback from previous buyers is gathered and presented in a way that persuades potential new customers that a product is high quality and good value.

Even tactics like display advertising in shops is known to influence consumer behavior, with certain prominent in-store locations getting more notice than other locations and thereby driving more sales.

How do governments influence consumer behavior?

Government's pursue policies aimed at influencing consumers when they believe that the economy is deviating from its long-run growth path. If they fear that growth is too slow, or that a recession is near, they may pursue expansionary monetary and/or fiscal policy. If, on the other hand, they believe that the economy is growing too fast and is starting to overheat, they may pursue contractionary policies to slow it down.

Both of these types of policies are called stabilization policy, and they relate to the business cycle. The idea is that by influencing consumers, it is possible to affect overall spending levels in the economy in order to avoid inflation or unemployment. The government's track record in this area is truly awful, but for more information I'd recommend reading my article at:

Unexplained Behaviors

There are many unexplained behaviors that are missed by the basic model presented on this page and the pages linked to above. The goal here is not to explain everything but just to build a foundation that gives useful general insights.

With that said, there are some specific aspects of consumer behavior that receive additional attention in the main textbooks, and these relate to decision making in the presence of risk. This, however, is a topic for another article or two.

Aside from risk assets, there is a great deal of work yet to be done in the economics discipline if reliable models of consumer behavior at the macro level are to be universally accepted. The problem in much of macroeconomic theory is that too many economists behave as though people are just like particles, and that mathematical equations can be built to model the behavior in more or less the same way that physicists build models to explain how particles behave.

This is a somewhat futile endeavor in many ways, because we cannot hope to model irrational behavior, and irrational behavior happens all the time. Nevertheless, in microeconomics we can certainly build useful models that do provide valuable insights, and in this section of the site I will do just that.

Related Pages: