Wage and Price Controls (Incomes Policy) Explained

Wage and price controls, i.e. incomes policy, represent one of the oldest government attempts to stabilize inflation during times of rapidly rising prices. They have been used, and misused, many times in the past and in many different countries around the world.

Unfortunately, despite their popularity, they carry a terrible reputation for failure. In most cases they actually work to make a bad situation even worse, because these sorts of direct top-down interventions in the free-market tend to create supply shortages.

In this article I will explain, with the use of a graph, why supply shortages tend to arise when these policies are enforced inappropriately or for too long.

I will also explain why, in some circumstances, there may be an important role for wage and price controls to play in stopping inflation, but only as part of a wider package of long-term changes to economic policy.

Wage and Price Controls Graph

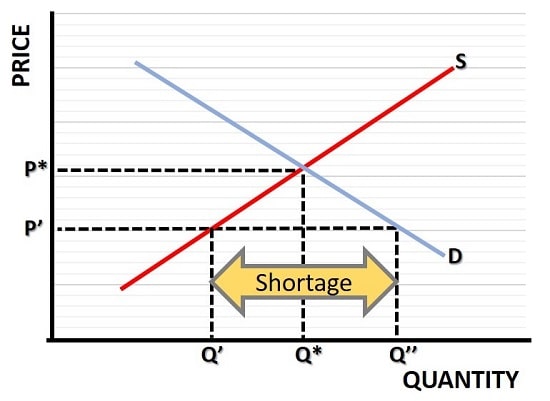

The wage and price controls graph below illustrates what happens when the government intervenes in a market to restrict prices to a level below the market clearing equilibrium level.

Let's suppose that the market under inspection is the labor market, and for simplicity let's assume that this graph represents the entire labor market in the economy. This is clearly a gross oversimplification, but it is one that does not invalidate the point being made.

We start with a simple supply and demand analysis where, at a price of P*, the supply of labor is equal to the demand for it. Workers and employers desire an equal quantity of labor at price P*, and the market clears at quantity Q*.

Now, the government decides to intervene in the labor market because it notices that wage rates (the price of labor) have been rising rapidly in recent times and that this is raising the costs of production such that firms have to keep increasing the prices of their products i.e., the so called 'wage-price spiral' is perpetuating inflation.

To relieve inflationary pressure, the government implements an incomes policy that prevents any further increases in wage rates.

At first glance we might imagine that by eliminating the wage-price spiral the government can reasonably expect that inflation will be brought under control. However, as explained in my article about cost push inflation, the reason why inflation gets out of control in the first place has nothing to do with wage demands.

The underlying causes of inflation are unlikely to have been resolved by this intervention alone and, in the next period, the market clearing wage of P* will almost certainly need to be higher than in the previous period. In terms of the graph above, the restricted wage is now represented by price P', well below the market clearing price of P*.

At a wage rate of P', firms would like to employ more workers, with a desired quantity of labor at Q''. However, at the restricted wage rate, workers will only supply Q' labor. A shortage of workers now exists that is equal to Q'' - Q' and this is clearly inefficient since we will now have unemployment in the economy equal to Q'' - Q'.

Is Incomes Policy always bad?

While the key points made in the analysis above are valid, it does not necessarily mean that there is no useful part to play for incomes policy. As I mentioned above, wage and price controls can be an effective short-term policy to reduce inflation, but they must be coupled with a package of long-term policies that resolve the underlying causes of inflation.

Incomes policy has a terrible record of failure precisely because those wider policies have rarely been used. The reason for that is because they usually require the government to make some difficult choices regarding cutting their spending programs.

US and UK Incomes policy in the 1970s failed because inflation at that time was caused by a significant contraction in aggregate supply, leading to rising prices even as unemployment increased (stagflation). Significant supply-side contractions in the economy are relatively rare, but they always cause serious structural problems in the economy that cannot be resolved without a permanent fall in living standards.

Where wage and price controls might be more effectively implemented is when we have growing inflation due to excessive aggregate demand growth. In this case, a short-term incomes policy combined with higher interest rates and fiscal policy cuts (in order to bring aggregate demand down to an appropriate level) could work well together to stop inflation.

Final Thoughts

Wage and price controls are a very blunt tool for tackling inflation, and previous attempts at utilizing them have failed in most circumstances. Those failures are as much due to incompetent handling of economic policy as they are to inherent failings in incomes policy itself.

In a system of fiat currencies with fractional reserve banking the frequency of severity of the boom and bust cycle is amplified because aggregate demand is more volatile (although this is not universally agreed, and mainstream economists, especially Keynesians, have a different view).

In the absence of a better system to stabilize aggregate demand, wage and price controls can help to bring inflation down in the short-term, but long-term solutions require fundamental solutions.

Related Pages: