- Home

- Business Cycle

- Positive Output Gap

Positive Output Gap Occurrences

For anyone who thinks that a positive output gap is a good thing, please read on, because another name for this phenomena is an unsustainable boom (with an inevitable crash to follow). Such occurrences may feel good at the time we experience them, but the long run costs always outweigh the short run benefits.

For more general details about fluctuations in output, see my main page about:

There is a particular problem relating to the positive output gap in that, when the prospect of an economic correction raises its head, our political masters' often do all that they can to 'kick the can down the road' by delaying the inevitable.

Whilst this may bring obvious political benefits in the short term (which may be enough for our politicians to achieve re-election) the long run consequences will only be all the more severe once reality asserts itself.

At the current time, and ever since the 2008 global financial crisis, government economic policy has consistently been weighted towards the ostrich technique i.e. sticking its collective heads in the sand and refusing to address the growing dangers to our future standards of living.

Before getting into those dangers, I'll start with an illustrative explanation of what a positive output gap is.

Positive Output Gap Graph

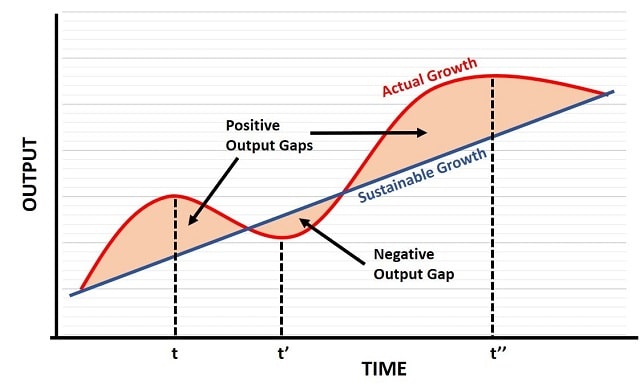

The positive output gap graph shown below illustrates the nature of the boom & bust business cycle for a typical western economy. The red line depicts the economic growth path that has occurred throughout modern history.

By starting at the left side of the red line, where it is equal to the blue long run sustainable growth path, we move towards time point t. We can see that, at time t, short term growth has exceeded the blue sustainable growth line, and that output (production levels) in the economy has reached a peak.

Left to itself a recession will develop with falling output levels until time point t'. After t' we then see the cycle come full circle with another rapid period of growth peaking at t''.

Typically, such growth peaks come with bottlenecks forming in key industries of the economy such that producers cannot keep up with the level of demand. This leads to rising prices in those industries, and typically it is the housing and real estate industry that experiences the most extreme production bottlenecks (and rising prices).

One of the big problems here comes with the malinvestment that is incentivized by distorted prices. If we think of this in terms of high prices encouraging firms to invest in more production then this is fine if, and only if, those higher prices are in long term equilibrium. If prices are only high because of a short term unsustainable boom, then the extra investment that was encouraged by those temporarily high prices will be misplaced, and losses will be suffered once equilibrium prices are reached.

The consequence of this kind of malinvestment is that the blue long-run sustainable growth path will be lowered, meaning permanent losses for society. In other words, this is not just a short term cyclical problem, it has permanent consequences.

Inflationary Output Gap Analysis

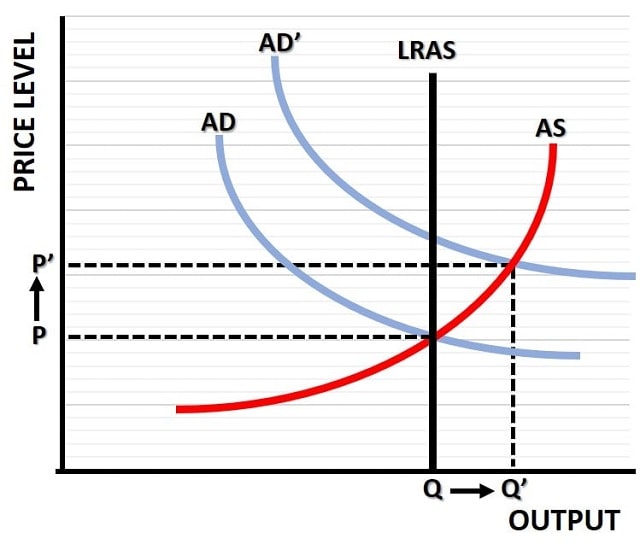

The permanent costs of short term fluctuations in the level of economic output are most clearly felt in the employment market, and on the price level. The AD-AS model below illustrates the first stage of the business cycle as it enters a boom which then causes an inflationary output gap.

This cycle almost always starts with aggregate demand growing at a faster rate than can be accommodated by the economy's productive capacity. In the diagram below we see this by the shift from AD to AD', which leads to a new short run intersection with the aggregate supply curve (AS) at a higher price level of p' and a higher output level of Q'.

Unfortunately, an output level of Q' can only be achieved by getting employees to work longer shifts and/or weekend shifts - both of which will be more expensive for the employer.

At the higher price level of p' those employees will suffer a fall in the purchasing power of their wages and they will start to demand higher pay.

Firms will be under a lot of pressure to comply due to the fact that employees are in high demand, and workers may be able to find alternative work if their demands are not accepted.

Ultimately firms will have to accept the higher wage demands, which will cause the AS curve to rise to a higher level. Output levels will now fall back to their original level, but prices will be permanently higher.

Now, imagine how much worse the situation would be if government policy reacted to the slowing output levels by boosting the money supply, and lowering interest rates, in order to encourage borrowing and spending. This might temporarily maintain output levels at Q', but it will also result in a further increase of aggregate demand beyond the AD' curve.

Ultimately this cannot continue, and the eventual economic correction will only be enlarged with even greater price increases and falling output levels. If the government persists with even more stimulus, then inflation will grow at an increasing rate until the entire monetary system collapses.

This is a good estimate of the situation that we find ourselves in at the current time.

The positive output gap that developed in the run up to the 2008 global financial crisis was so large that the correction that followed it threatened to destroy the monetary system (because our banking sector had lent so heavily to fund the overheated housing and real estate sector that any fall in real estate prices would leave homeowners with negative equity, and when the inevitable mortgage defaults followed that, the banks would be insolvent).

Our political masters may hide behind their comical CPI estimates of inflation, but any objective assessment of domestic prices will uncover the truth, and in any case the overheated real estate market and subsequent collapse of property prices is well documented.

Responsible economic management would seek to drastically reduce the boom bust cycle to prevent these positive output gap problems from getting out of hand, but that would require the abandonment of Keynesian demand management policies, and probably the replacement of the fractional reserve banking system.

You shouldn't hold your breath for either of these developments...

Related Pages: