- Home

- Aggregate Demand

- Marginal Propensity to Save

Marginal

Propensity to Save Problems & Criticisms

The marginal propensity to save is defined as the proportion of additional income that individuals or households choose to save rather than spend. It is a concept that stems from Keynesian economics, and it refers to net saving not gross saving, and usually over the period of a year.

Net saving differs from gross saving because a great deal of the saving done by some people is borrowed by other people in order to fund their consumption. Net saving is treated as an amount that is available to fund investment, rather than consumption.

However, there are complications in the real-world that are not addressed by the standard textbook explanations of the marginal propensity to save. This is because the textbook models start from very basic beginnings that assume no foreign trade, no government, and no ability to borrow from future generations. With these added complications, the relationship between saving and investment, in a given place over a given time-period, is heavily distorted.

In this article, we will delve deeper into the concept of the marginal propensity to save in a real-world setting, and explore its implications for economic growth and stability when the relationship between saving and investment is somewhat flexible.

The Basic Marginal

Propensity to Save Formula & Graph

To work out how to calculate marginal propensity to save we just need to calculate the slope of the saving function. This is usually presented as a straight line, meaning a constant slope and therefore a constant MPS.

I have previously written about the basic approach to the marginal propensity to save (MPS), and you can read that article at ‘The Saving Function’, but here is a quick refresher.

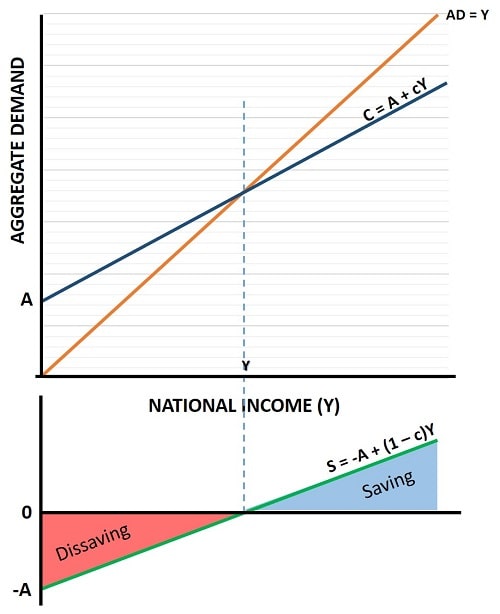

The saving function is derived from the consumption function which takes the form C = A + cY where ‘C’ is consumption, ‘A’ is autonomous consumption (not related to income), and cY is a proportion of income that goes towards consumption.

The Saving Function describes the basic Marginal Propensity to Save model.

The Saving Function describes the basic Marginal Propensity to Save model.Since we assume that saving is simply non-consumption, we can deduce that the saving function equals 1 – C or 1 – (A + cY) which transposes to S = -A + (1 – c)Y. This is the equation of a straight line where (1 – c) is the slope of the saving function i.e., the MPS. This is illustrated in the marginal propensity to save graph above.

The larger the marginal propensity to save, the steeper the saving function and the less steep is the consumption function. This would result in a smaller multiplier effect on national income from any initial increase in consumption, (click the link for details).

There are some commentators who insist that a higher MPS would cause a loss of national income via reduced consumption, the so-called ‘Paradox of Thrift’, but this would only happen in the short-run because the underlying economic growth rate would be pushed higher via greater investment. This dynamic is explained by the growth models, such as the Solow Growth Model.

Average Propensity to Save

The average propensity to save formula is simply total saving divided by total income. Unlike the MPS it is not constant, and ranges from a negative value to an increasingly positive value as income increases. This is because, at low levels of income, dissaving will occur, as illustrated in the graph above.

Criticisms

of the basic MPS assumptions

Some of the main criticisms of the basic model include:

- Simplified assumptions: The MPS is based on the assumption that individuals make rational decisions when it comes to saving. However, in reality, individuals' saving behavior can be influenced by various psychological and socio-economic factors, making it more complex than what the MPS suggests.

- Lack of consideration for wealth distribution: The MPS focuses on income levels and saving behavior, but it does not take into account wealth distribution. Wealth inequality can significantly impact saving patterns and can lead to disparities in the MPS among different income groups.

- Dynamic nature of the MPS: It is not a fixed value as suggested, and it can change over time in response to various factors such as economic conditions, policy changes, and individual circumstances. This dynamic nature makes it challenging to rely on the MPS as an economic indicator.

Real-World

Complications

Permanent

Trade Deficits

In the basic model the assumption that saving equals investment is broken by the addition of a foreign trade sector. The basic model assumes a closed economy, and while it is true that the world economy is indeed a closed economy, each individual country has an open economy if it trades with other countries.

This opens the possibility of investment in one country being funded by saving in another country, but this can only happen if one country has a trade surplus and the other a trade deficit. Much of the western world operates in a trade deficit, whereby trade surplus countries (most notably China) receive net cash outflows from the deficit countries. They then, for the most part, reinvest those foreign earnings back into the deficit countries i.e., deficit countries run surpluses on the capital account of their balance of payments accounts.

The problem here is that permanent capital account surpluses i.e., borrowing from countries with trade surpluses, is not sustainable unless that borrowing funds genuine investment projects that can make profits from which to pay off the interest on the borrowed money. In practice this seldom happens; much of the borrowing is done by western governments to fund ill conceived social programs or worse still, foreign wars and regime change programs.

This has been one of the primary mechanisms that have led to the enormous and unsustainable debt levels in the western world, and the problem is only getting worse.

The

Fractional Reserve Fiat System

Another huge problem that the basic MPS model misses is the role of the modern banking system. With a fiat monetary system and fractional reserve banking, our governments, central bankers, and commercial banks are able to create money more or less out of thin air, and without any need for savers at home, or even abroad, to fund their borrowing.

Keynes’s liquidity preference theory shows how, with a fractional reserve system, there is no need for a market clearing interest rate to exist that matches the amount of saving to the amount of investment. Keynes did intend this as a short-run model whereby interest rates could be brought lower than the underlying market rate in order to boost spending and investment when the economy is in a downturn.

This would avoid the likelihood of inflation arising since, in an economic downturn, there is spare capacity in the economy to expand production without the need for rising prices. However, the model has been abused repeatedly, and used more or less constantly over many decades and regardless of economic circumstances.

By ‘printing’ new money into existence, it is possible to fund current consumption and investment by pushing the repayment costs onto future generations. Again, this would not be a problem if the printed money went towards funding genuine investment projects, but that has not often been the case. As a consequence, consumer price inflation has appeared, and it works like a hidden tax as ‘seigniorage’ erodes the purchasing power of the currency.

The harmful effects of this kind of money-printing are particularly deleterious for the elderly and other savers, because it erodes the purchasing power of their savings and pensions.

Conclusion

The relationship between the marginal propensity to save and economic growth is intricate and multi-faceted. Its immediate effects on economic output, through its impact on consumer spending, investment, and aggregate demand, are negative. When individuals save a higher proportion of their income, it reduces their immediate consumption, leading to lower consumer spending. This decrease in consumer spending can have a dampening effect on economic growth, as it reduces the overall demand for goods and services.

However, the MPS can also influence investment levels in an economy. When individuals save a larger portion of their income, it increases the pool of available funds for investment purposes. This increase in savings can lead to higher levels of investment, which in turn, can fuel economic growth through increased production, job creation, and innovation.

The model has serious flaws relating to how the ideas underlying it have been implemented in the real-world. This is no criticism of the basic tenets of the model but, as with so many Keynesian models, it has been repeatedly abused by modern policymakers.

The ever-intensifying pursuit of unsustainable economic output, in the form of an ever-lower MPS that fuels current consumption at the expense of current saving and investment, lies at the heart of many of our current global indebtedness problems.

Related Pages: