- Home

- Market Failure

- Marginal External Cost

Marginal External Cost Explained

Marginal external cost is a term associated with negative externalities involved in a trade, i.e. bad effects suffered by third parties as a result of a trade between a buyer and a seller of a good or service.

There is, of course, a huge incidence of such situations in the real world that occur every day, but the vast majority of them are of only minor impact and are not significant enough to warrant any corrective action.

When the marginal external cost of production/consumption is significant, then it must be taken into account when making production/consumption decisions if society is to achieve optimal outcomes.

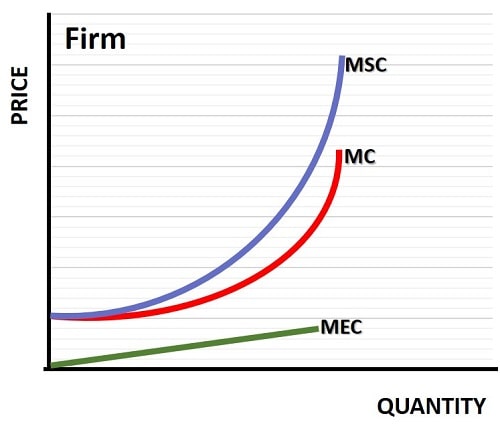

The marginal external cost curve (MEC) forms a component of the overall marginal social cost curve (MSC) as illustrated in the graph below, and by the equation:

MSC = MEC + MPC.

The only potential for confusion here is that MPC (marginal private cost) tends to be the preferred term when looking into externalities, rather than the more standard term MC (marginal cost).

The standard MC is basically the same concept, and since most industries are not considered to have significant externalities, there is usually no need to distinguish between private and external costs.

Marginal External Cost Formula

A simple rearrangement (transposition) of the equation above gives us the result that:

MEC = MSC - MPC

This is the marginal external cost formula.

We may or may not know how to calculate marginal external cost, with any degree of precision, depending on the nature of problem, but on the graph the MSC curve is raised higher than the MC curve (or MPC curve if you prefer) by the height of the MEC curve at each point.

The graph used above is labelled as applying to an individual firm, but the same analysis applies for the entire industry. The degree of competitiveness in any given industry does not affect the curves or their relationship to one another.

The level of competition would, of course, affect price and output decisions, and by extension the amount of external cost produced, but that can be mitigated by the right combination of corrective taxation imposed on the industry by government.

Slope of the Marginal External Cost Curve

For simplicity we assume that marginal external cost increases at a constant rate, and so the curve is actually a straight line, but this may or may not reflect reality depending upon each case.

Some situations may see increasingly large external costs produced with each extra unit of output, in which case the MEC curve would slope upwards at an increasingly steep rate.

In other situations it may be that external costs hit a peak at some critical output level, and incur no further costs from additional output. Each case is unique.

Marginal External Cost Example

The obvious example of significant marginal external cost being imposed on third parties is that of pollution. Pollution may be created as part of the production process, or from the waste created by consumption e.g. throwaway plastic containers.

Problems of this nature can be very difficult to correct due to the global impact that they have. Carbon emissions pollute the atmosphere, waste plastic pollutes the oceans, but any specific country where such pollution is created has an incentive to ignore it since much of the costs fall upon other countries.

Obviously, if the costs fell entirely upon the country where the pollution is created then there would be sufficient marginal external cost created to motivate corrective action, but this is not so when the costs are dispersed globally.

In these circumstances, global initiatives to promote environmentally friendly measures may be adopted, as well as potential restrictive trade policies, such as tariffs, may be used to tackle marginal external cost problems.

Related Pages: