Is Stagflation worse than Recession?

In economics, whether or not stagflation is worse than recession usually comes down to the severity of either case. Undoubtedly, stagflation poses the greater threat, and it may well lead to an extremely severe recession meaning that the two are not mutually exclusive events.

An economic recession simply implies negative GDP growth. In practice, most recessions result from falling aggregate-demand following an unsustainable period of booming economic growth, and that typically causes consumer price inflation to slow, or even to fall.

Stagflation, on the other hand, exists when consumer price inflation is rising even as GDP growth is stagnant i.e., sluggish to zero growth. However, the term ‘stagflation’ is still used to describe a situation of concurrent rising consumer price inflation AND negative GDP growth. When that happens, the economy suffers a combination of supply-side and demand-side problems that are usually worse than mere recession alone.

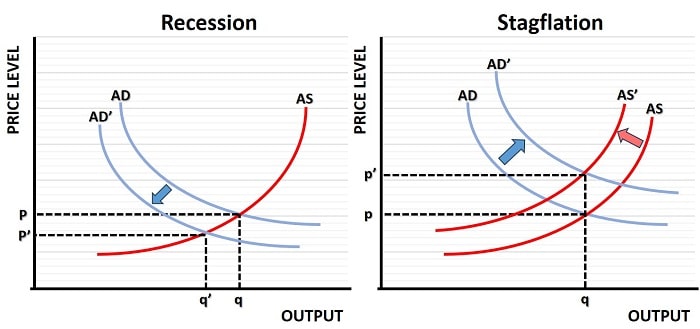

Only when declining aggregate-supply occurs is there a threat of rising price inflation concurrent with recession, as illustrated in the graph below.

On the left side of the graph, a recession usually occurs after an unsustainable boom, meaning that declining aggregate demand occurs. This results in falling economic output from q to q' and deflationary pressures (or at least a lower rate of inflation) as illustrated by the fall in the price level from p to p'.

On the right side of the graph, a contraction of aggregate supply occurs after a rise in the costs of production e.g., higher oil prices (or after a lockdown that stops production). The government and central bank will usually enact discretionary fiscal policy and monetary policy stimulus packages to boost aggregate demand so as to avoid a loss of economic output. However, this leads to a significant increase in the price level i.e., higher inflation.

With stagflation, much depends on what comes next i.e., can the economy absorb the increased inflation via productivity improvements (allowing aggregate supply to return to its original level so that stimulus packages can also be retracted), or will inflation become entrenched. If the latter, stimulus packages will need to go sharply into reverse with higher interest rates and a very serious recession to follow.

Understanding

stagflation

Traditionally, economists believed that high inflation simply resulted from robust economic growth, as increased demand led to higher prices. This relationship is described by the ‘Phillips Curve’ and was a cornerstone of macroeconomic modelling right up to the 1970s.

However, the stagflation of the 1970s challenged the Phillips Curve principles by presenting a scenario where prices were rising rapidly, but the overall economy was not expanding. This was a perplexing situation for policymakers, as the tools typically used to combat inflation, such as raising interest rates or reducing government spending, could further hinder economic growth.

Stagflation is often caused by a combination of external shocks, such as an oil crisis or supply disruptions, coupled with resulting internal factors such as wage-price spirals resulting in cost-push inflation. The consequences of this can be severe, as it can lead to high unemployment rates, reduced consumer spending power, and increased social unrest.

Impact of

stagflation on different sectors

Stagflation can have varying impacts on different sectors of the economy. Supply-side disruptions usually come with increased energy costs like higher oil prices, and while this will affect almost all industries it is particularly difficult for the biggest industrial users of energy i.e., the manufacturing sector. Manufacturing during the 1970s stagflation was particularly hard-hit by the rising oil prices at that time, and it played a significant role in the ‘offshoring’ that followed.

Much of our traditional manufacturing sector has relocated to countries with cheaper costs, especially cheaper labor costs, since the 1970s. Of course, this process has itself created further supply-side vulnerabilities, as evidenced by the shortages of key items during the pandemic lockdowns of 2020.

Understanding Recession

A typical recession refers to a period of economic decline characterized by reduced spending, business activity, and overall economic output. During a recession, consumers tend to cut back on discretionary spending, leading to a decrease in demand for goods and services. This, in turn, affects businesses, which may be forced to lay off workers with resulting loss of production.

The causes of recession can vary, ranging from financial crises to natural disasters or shifts in global economic trends. Regardless of the cause, recessions can have far-reaching impacts on individuals and communities, including higher unemployment rates, reduced incomes, and increased levels of poverty.

Governments and central banks often implement various measures, such as fiscal stimulus or monetary easing, to revive economic growth during a recession but, as mentioned already, such stimulus measures may only make matters worse in a stagflation since they will add fuel to the inflation fire and threaten an even worse recession in the following months and years.

Impact of

recession on different sectors

During a recession, consumers tend to cut back on discretionary spending, leading to reduced demand for goods and services. Industries such as retail, hospitality, and luxury goods may experience a significant decline in sales, as consumers prioritize essential items and reduce non-essential purchases.

The construction and real estate sectors are also heavily affected by recessions, as reduced consumer spending and confidence lead to a decline in housing demand and construction activity. Manufacturing and industrial sectors may experience a decrease in orders and production, as businesses scale back their operations in response to reduced demand.

Additionally, the financial sector is vulnerable during recessions, as declining asset values and increased loan defaults can lead to financial instability.

Key Differences

between Stagflation and Recession

Stagflation challenges conventional Keynesian economic theories that are based on the traditional Phillips Curve, but the augmented Phillips curve used in the NAIRU incorporates the role of expectations into the model, and this helps to highlight the stark choices posed to policymakers during such times. They face the challenge of simultaneously combating inflation and stimulating economic growth, but improving one causes deterioration in the other.

In practice, the only way to restore growth and full employment when stagflation occurs is to first endure even higher unemployment in order to first get inflation under control. Only then can productivity improvements start to restore growth and employment levels.

With a simple recession, absent any deterioration in supply-side costs of production, the transition period to stable GDP and unemployment is shorter, because governments are able to immediately add stimulus packages in order to mitigate declining demand-side factors like reduced consumer spending and business investment.

Strategies

to mitigate the effects of stagflation and recession

Mitigating the effects of stagflation and recession requires a comprehensive approach that addresses both short-term challenges and long-term structural issues.

If policymakers act in the best interests of the economy, rather than in their own short-term political interests, they will first implement measures to control inflation. This will likely entail reducing discretionary fiscal spending and, in some cases, this may be combined with temporary wage & price controls. At the same time, efforts should be made to stimulate economic growth by encouraging investment and reducing regulatory burdens on businesses.

In the case of recession, fiscal stimulus packages can help boost economic activity and create jobs. Governments can invest in infrastructure projects, provide support for struggling industries, and offer training programs to enhance the skills of the workforce and reduce barriers to work.

Conclusion: Is

Stagflation Worse than Recession?

While stagflation presents a troubling combination of stagnant (or falling) economic growth and high inflation due to supply-side contraction, recession is characterized by a decline in economic activity via reduced consumer spending and business investment.

Stagflation is usually worse due to the extra difficulties posed by inflation and, if left unchecked, it can be a prelude to hyperinflation.

Recession, if left unchecked, may ultimately lead to deflation and something akin to the Great Depression of the 1930s, but even that is not as bad as the worst cases of hyperinflation.

Governments play a crucial role in responding to these economic phenomena, but their short-term political motivations often conflict with the best interests of the economy.

Related Pages: