- Home

- Aggregate Demand

- Affect of Government Spending

How does government spending affect aggregate demand?

The use of government spending to affect aggregate demand is one of the cornerstones of macroeconomic policy, and it is referred to as fiscal policy. Technically speaking, tax cuts/increases can also be used for a similar purpose, but direct government spending manipulation is usually the preferred method of enacting fiscal policy.

The reason for this preference is that increases/decreases in spending will have an immediate impact on the economy whereas tax changes may, to some extent, lead to changes in saving rates rather than spending rates. If that were to happen, the fiscal policy action would be somewhat reduced in effectiveness.

In this article I will start with an overview of the textbook model of government spending on aggregate demand. This is a Keynesian model, and as always there are alternative theories which I will briefly discuss below.

The Aggregate Demand Function

Consider the aggregate demand function, Y = C + I + G + (X – M)

For full information on this function, and its determinants, have a look at my main article The Aggregate Expenditure Model.

The 'G' in this function stands for net government spending and, for obvious reasons, it is a much easier component for the government to fully manipulate as desired.

I should note that in normal times, i.e. times when the economy is not in a liquidity trap with near zero interest rates regardless of money-supply manipulation, fiscal policy is not usually the preferred economic stabilization tool in times of need. Monetary policy is usually the first line of defense, but when that runs out of steam we tend to see more fiscal actions by the government to try and steady the economic ship.

Monetary policy is usually controlled by central banks rather than governments, but again this only really applies during normal times. There is a great deal of speculation at the current time as to just how independent these central banks really are, and to what extent they are influenced by government officials.

Regardless of the true nature of central bank independence, fiscal policy has surfaced in recent times as the most important policy tool for controlling the economy. That means that the level of government spending via stimulus packages, infrastructure investment, welfare support, and so on, is the main instrument of macroeconomic management.

There are of course, no policy tools that can maintain disequilibrium in an economy indefinitely, and I'll leave it to the reader to decide whether or not they regard the size of national debt levels throughout the western world, and the enormous trade deficits, and the enormous budget deficits, and the fact that our debtors are starting to refuse to lend more money to us, and the fact that we are printing money at insane levels at a time of growing inflationary pressure, whether any of this makes any sense and whether it is sustainable.

The

Keynesian Perspective on Government Spending

The Keynesian perspective on government spending posits that, during times of economic downturn, the government can boost aggregate demand through increased spending. According to John Maynard Keynes himself, government spending can stimulate the economy by directly injecting money into the economy.

Keynes was advocating for active fiscal policy during the fixed exchange rate Bretton Woods system of the time, and according to the Mundell-Fleming Model fiscal policy should indeed be effective under such a system.

The idea is that actively boosting government spending will create jobs and increase consumer spending. Keynes argued that in times of recession or depression, private sector spending tends to decrease, leading to a decline in aggregate demand. In such circumstances, government intervention through increased spending can help fill the spending gap and reignite economic activity.

The

Monetarist Perspective on Government Spending

In contrast to the Keynesian perspective, monetarists believe that government spending has limited impact on aggregate demand. They argue that the crowding out effect limits the impact of extra government spending, unless new money is printed to pay for it. Even then, the various lags of stabilization policy can lead to adverse consequences.

Monetarism, championed by economists such as Milton Friedman, argue that the money-supply is the key determinant of aggregate demand, and that the government's role should be focused on maintaining price stability rather than actively stimulating the economy through increased spending.

Monetarists advocate for a stable and predictable monetary policy that allows businesses and individuals to plan their economic activities with confidence. In their view, excessive government spending can distort market signals and lead to misallocation of resources.

The

Classical Perspective on Government Spending

The classical perspective on government spending emphasizes the importance of limited government intervention in the economy. Classical economists, such as Adam Smith and David Ricardo, argue that government spending should be minimal, and that the market forces of supply and demand should be allowed to function freely.

The key difference here is that classical economists regard short-term fluctuations in economic output as being of limited duration, and that the free-market will quickly correct itself. Keynesians dispute this and contend that the short-term can last far too long if left untreated.

The Keynesian viewpoint is built off the experiences of the Great Depression, and the long-lasting economic consequences that it brought. Classical economists, Monetarists, and free-market advocates point out that the Great Depression did not arise from the free functioning of markets. Instead, it arose from incompetent Federal Reserve handling of the money-supply and interest rate policy.

Conclusion: How does government spending affect aggregate demand?

The link between government spending and aggregate demand is a complex and multifaceted topic that continues to be debated among leading economists to this day. From the Keynesian perspective to the theories of Monetarists and Classical economists, various schools of thought have shaped our understanding of this relationship.

While government spending can be an effective tool for countercyclical policy, it is not without its criticisms. Critics argue that increased government spending can lead to budget deficits, inflation, and misallocation of resources.

Related Pages:

- How to calculate aggregate demand

- How do lower taxes affect aggregate demand?

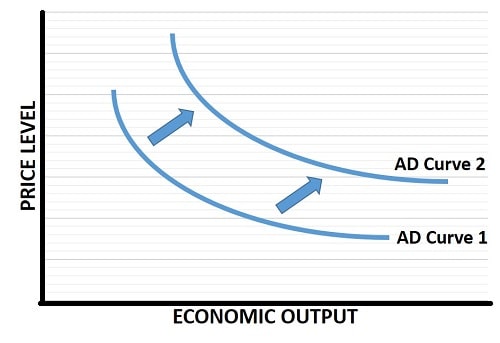

- The Aggregate Demand Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

Bank Reserves, Asset Inflation, and the Risk of Future Price Inflation

Dec 19, 25 04:16 AM

Learn what bank reserves are, how they affect asset prices, and why future reserve creation could lead to inflation through commodities and currencies. -

Credit Creation Theory; How Money Is Actually Created

Dec 16, 25 03:07 PM

Explore how modern banks create money through credit creation, why the money multiplier fails, and the role of central banks and reserves. -

U.S. Industrial Policy & The Unfortunate Sacrifice that Must be Made

Dec 12, 25 03:03 AM

U.S. Industrial Policy now demands a costly tradeoff, forcing America to rebuild its industry while sacrificing bond values, pensions, and the cost of living. -

The Global Currency Reset and the End of Monetary Illusion

Dec 07, 25 03:48 AM

The global currency reset is coming. Learn why debt, inflation, and history’s warnings point to a looming transformation of the world’s financial system. -

Energy Economics and the Slow Unraveling of the Modern West

Dec 06, 25 05:18 AM

Energy economics is reshaping global power as the West faces decline. Explore how energy, geopolitics, and resource realities drive the unfolding crisis.