- Home

- Aggregate Demand

- Affect of Taxes

How do lower taxes affect aggregate demand?

Lower taxes have the effect of boosting aggregate demand due to the extra spending power that consumers will have once they are paying lower taxes. This, however, is not the preferred method of boosting the economy when a boost is deemed necessary.

Tax cuts do not fully translate into higher spending levels in the economy, because consumers can choose to increase their savings too. This is what John Maynard Keynes was referring to in his ‘fundamental psychological law’ quote i.e. that spending will increase as income rises, but not by as much.

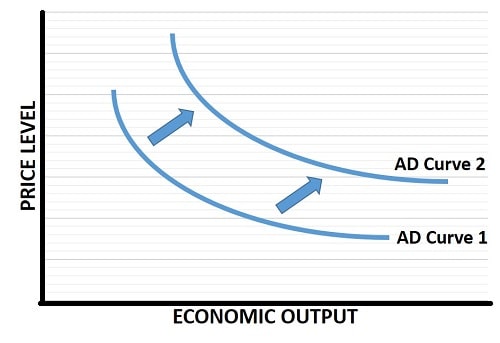

Tax cuts shift aggregate demand

As I have set out before, the aggregate demand function is written: Y = C + I + G + (X – M).

The ‘C’ in this function refers to consumption, and it is this component of aggregate demand that will rise when taxes are cut.

For full explanation of the determinants of aggregate expenditure and its functioning, have a look at my main article:

The Aggregate Expenditure Model

In a closed economy with no international trade there would be no exports or imports, and X-M disappears from the function. The implication then is that any saving would end up being lent by the banks to fund other people’s consumption, or to fund investment (I) in the domestic economy.

At the same time, since there are no imports to consume, only domestic goods and services can be consumed meaning that the full effect of extra spending would impact the domestic economy. Therefore, in a closed economy, tax cuts would be more effective at boosting the economy.

Of course, we do not live in a closed economy, and lower taxes will tend to have a greater amount of dampening on overall spending in the domestic economy than its preferred fiscal policy alternative i.e., increased government spending.

Government spending can be targeted at key initiatives, such as infrastructure spending, in order to make sure that the economy is boosted directly, and with maximum effect in the short-term. This is only intended to be a short-term boost, at least if macroeconomic theory is followed, because the idea is simply to smooth out the economic growth path.

Growth that is too high, or too slow, is supposed to be managed. What is not supposed to happen is that the government puts its foot on the accelerator until the entire system collapses... contrary to what has actually been happening in recent times!