What is the Fisher Equation in Economics? (Formula & Example)

The Fisher equation, named after its inventor Irving Fisher, is a simple formula that economists use to describe the long-term relationship between the inflation rate and the nominal interest rate in an economy.

There is some controversy about the value or accuracy of the equation, primarily coming from Keynesian economists, and in this article I will address these concerns while providing some evidence of how inflation and interest rates have actually behaved since the mid 1950s.

A key point to keep in mind is that the model developed here relies on the free functioning of a market economy, without excessive interference from the government or monetary authority. As I will explain below, the period up to the 2008 financial crisis was quite different in this regard to the period since 2008.

Fisher Equation Formula

The Fisher equation formula states that the expected interest rate (rᵉ) is equal to the nominal interest rate (i) minus the expected rate of inflation (πᵉ). This is written as:

rᵉ = i - πᵉ

I should reiterate here that this is a long-run model and that there may be significant deviations from this equation in the short-run. However, the Fisher equation will eventually assert itself because lenders will require a positive real rate of return.

They will not forever lend money at a nominal rate of interest that is lower than the expected inflation rate, because that would mean that they would expect to receive depreciated repayments that have less purchasing power than the money they lent.

Of course, expectations are themselves volatile in the short-run when economic cycles are working themselves out, but in the long-run the economy is stable with a stable full-employment rate. In these circumstances, the nominal interest rate is equal to the full-employment interest rate plus the inflation rate. This is written as:

i = r* + π

In this equation, r* is the full-employment real interest rate.

The point here is that economic agents will not be fooled forever. In the long-run, actual inflation and expected inflation will be more or less equal. Any increase in the inflation rate will simply lead to an equal increase in the nominal interest rate so that real returns are maintained.

Fisher Equation Example

An important question relates to how long the short-run lasts, because the relevant timeframe is the main dividing issue between Keynesian economists and classical economists.

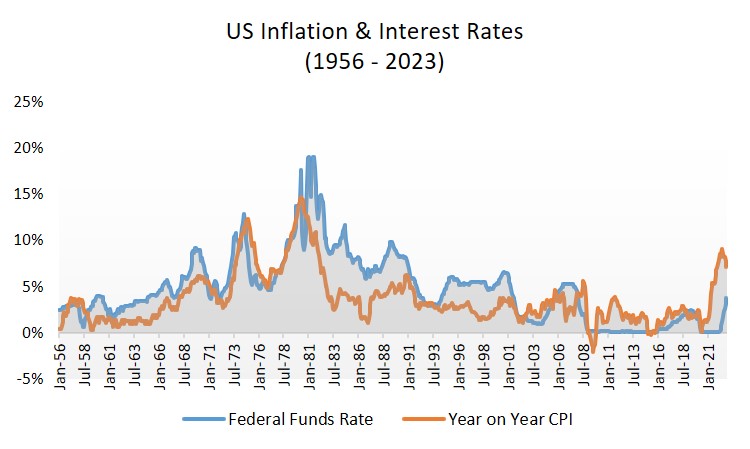

As the graph below illustrates, the long-run relationship between inflation and interest rates is clear, and they track each other fairly well. The nominal interest rate (Federal Funds Rate in the graph) tends to be a few percentage points higher than inflation (year on year CPI) due to the requirement that lenders need to receive a positive real rate of interest.

Up to 2008, periods of inflation rising above the nominal interest rate were rare and short-lived. However, after the 2008 financial crisis everything changed. The years since 2008 have seen persistently lower interest rates than inflation rates, because the Federal Reserve pursued a policy of quantitative easing and loose money-supply in order to avoid recession.

By 2021 the consequences of this (along with the economic consequences of the Covid-19 lockdowns and stimulus spending) were becoming apparent. Inflation started getting out of control even as the economy was stumbling towards a likely recession. I've written more about this in my article about Reflation.

It is also important to understand the relationship between the money-supply, the rate at which it circulates, the price level, and the rate of production in the economy. This will give a better picture of how inflation can get out of control. For details on that see my article about the Quantity Theory of Money.

How can Inflation be higher than the Interest Rate?

If all interest rates were set by the free-market, it would be unlikely that inflation would ever rise above even the lowest interest rate. That's because, as explained above, lenders won't lend unless a positive real rate of interest is offered to them. Similarly, savers won't save unless by doing so they earn a positive real rate of interest.

Unfortunately, interest rates are not set by the market, they are manipulated by governments and central banks to target short-term goals - like smoothing out the business cycle. Of course, their competence in achieving these aims is open to question, but their track record is abysmal. There is growing evidence that central banks exacerbate the business cycle rather than smooth it out.

Politicians, of course, have a conflict of interest between managing the business cycle and managing the electoral cycle, but I will leave it to the reader to decide which of these cycles has dominated policy in recent decades.

In any case, holding interest rates below the market rate, let alone below the inflation rate, will have long-term consequences in the form of malinvestment i.e., investment in low-return companies that will likely collapse in the event of higher interest rates. These are called zombie companies, as they can only survive on ultra-low costs of finance.

The economy will, of course, return to normal at some point (assuming that we don't lurch to the hard-left and adopt socialism). Unfortunately, a serious economic correction will have to come first, and only after we get through that can the Fisher equation reassert itself.

Related Pages:

- What is Inflation?

- What Causes Inflation?

- How to Stop Inflation

- Adaptive Expectations

- Demand Destruction

- Rent and Price Controls