- Home

- Market Failure

- Corrective Tax

Corrective Tax Definition & Examples

A corrective tax (also called Pigouvian tax) is the name given to a tax that is levied on a good/service because of the negative externalities associated with its production, and/or consumption. The idea is to make its market price and output levels a better reflection of its real cost to society.

The name comes from Arthur Cecil Pigou, an English economist of the early 20th century who made a number of contributions to economic science, including the concept of externalities i.e. costs/benefits accruing to a third party from the economic activities of other people.

In the case of corrective taxation, it needs to be clear that a third party is being affected in a negative way, and this is the justification for imposing a tax. A Pigouvian subsidy, by contrast, would be a reward to producers/consumers in order to encourage greater production and consumption.

The economic justification is best illustrated with a graph.

Corrective Tax Graph

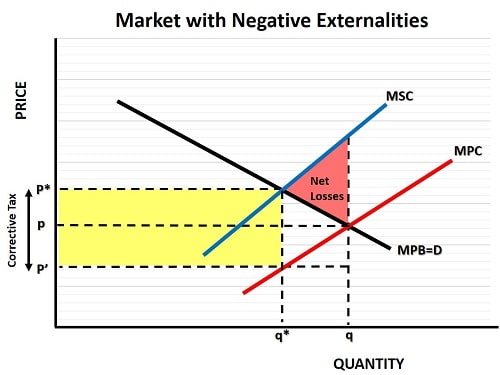

The graph below will be familiar to students of deadweight losses, and producer & consumer surplus models. In the absence of a tax, a market will produce at the intersection of its supply and demand curves. These are represented by the marginal private cost (MPC) curve and the marginal private benefit (MPB) curve.

It is conventional in economics to use the MPC and MSC terms in the presence of externalities, but these curves are not different to standard supply and demand curves. The point is just to highlight the presence of an economic cost, or a liability, that is not reflected by private buying and selling decisions.

The free market will produce output q, at a price of p, if it is left to its own devices. This, however, is not the most efficient outcome.

The Marginal Social Cost (MSC) curve is higher than the MPC curve because it reflects all the costs, private and external, to society as a whole. The red shaded area on the graph represents the economic losses to society from ignoring the true cost curve. The efficient equilibrium point occurs at the intersection of the MPB and MSC curves, with an output of q* and a price of p*.

In order to achieve this efficient equilibrium, the government can levy a corrective tax. This would usually be charged to the producer, who would then pass on as much of it as possible to consumers. How much can be passed on will depend on the price elasticity of demand for the product.

How to find the Optimal Corrective Tax Formula

Assuming that the government can accurately estimate the MPB and MPC curves, it will know that at an output level of q* consumers will be willing to pay a price of p*, and it will also know that producers will be happy enough to produce q* for a much lower price of p'. Therefore, the optimal corrective tax should be set equal to p* - p'.

This will bring a significant inflow of revenue for the government, which is equal to the yellow shaded area and can be expressed as a formula where the inflow = q*(p* - p').

In practice the extra inflow of funds for the government might create some extra spending by that government (rather than a reduction in other taxes to offset the increase), and that raises further questions as to the optimal corrective tax rate and the likely economic efficiency of the extra spending. Typically it leads to a great deal of waste, but this whole question is just something to keep in mind, and somewhat superfluous to the general point being made here.

Examples of Corrective Taxes

There are a lot of markets that are subject to these sorts of taxes, and together they contribute a large proportion of overall tax receipts, though information about the exact proportion differs from one country to the next.

The most obvious examples of industries that are subject to these taxes are:

- Oil & Gas - because of the carbon emissions they create

- Tobacco - because of the health costs, and treatment costs

- Alcohol - again because of the health costs, and addiction costs

- Chemicals - because of pollutants

There are many more corrective tax examples, but I think that you get the idea.

Internalities in the Economy

Related to the concept of externalities in the economy is that of internalities, i.e. where there is no third party affected by a transaction between buyer and seller but where there are additional costs and/or benefits that are overlooked by the buyer/seller. Usually this will apply to long run side-effects that are discounted by the buyer in favor of short-term benefits.

The obvious example here relates to drug and alcohol abuse by addicts. Most hard drugs are prohibited because of these negative internalities, and the taxes that are levied on legal drugs such as alcohol and nicotine are intended to reduce consumption to a level at which most people will not overindulge. The extra funds generated by these taxes can also be used to mitigate the future health costs imposed on society by those people who end up needing medical care as a result of drug abuse.

Naturally, the question of what amount of corrective tax should be imposed in these circumstances is highly debatable, and it is impossible to calculate the economics involved with any degree of precision. In these cases we typically make a human judgment about the proper course of action, and policy development is guided more by our instinctive values.

Sources:

Related Pages: