- Home

- Unemployment

- Beveridge Curve

The Beveridge Curve Explained

Despite having been around for a long time, the Beveridge Curve model of unemployment has received relatively little attention in economic circles, until recently. Research by some of today's leading economists has adapted the theory, with accompanying claims of highly accurate accounting of employment patterns over recent decades.

Whilst the old theory presented a simple downward sloping curve that illustrated the relationship between job vacancy rates and unemployment rates (i.e. when vacancies are high unemployment tends to be low and vice-versa) in an economy, the latest adaptation includes a more sophisticated model of job matching flows into and out of the labor market.

In this report I will give an elementary explanation of the Beveridge curve, and go on to relate it to the main forms of unemployment that exist in the economy (with particular focus on cyclical and structural unemployment).

What is the Beveridge Curve

The Beveridge curve is named after Lord William Henry Beveridge (1879 - 1963), the founder of the modern British welfare system, and whilst he never illustrated his ideas into the standard graph below, he did write extensively on the main ideas behind it.

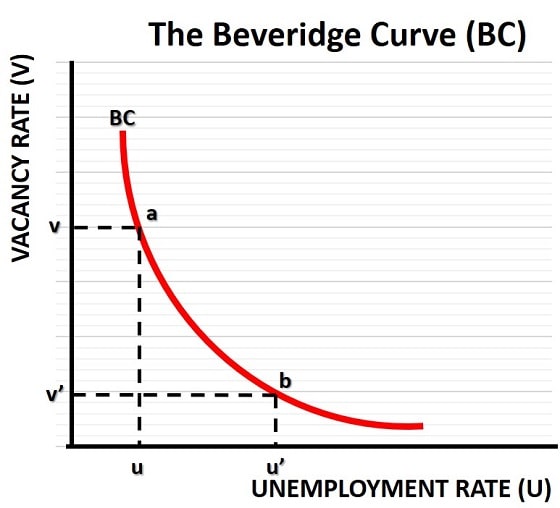

The two basic variables under investigation are the jobs vacancy rate and the unemployment rate. The vacancy rate is usually illustrated on the vertical axis of the Beveridge Curve graph, whilst the unemployment rate goes on the horizontal axis. The curve, sometimes called the uv curve, illustrates that the relationship between these two variables is a negative one, i.e. as one increases the other decreases.

The simple idea here is that, in times of rapid economic expansions, business will increase the job openings rate as they seek to expand economic production. As a consequence, more people will enter employment and so the unemployment rate will fall. The reverse logic applies in times of recession.

In the graph, we can see that an economy which is at point a is at a higher point in the business cycle than an economy at point b. In other words, movements along the Beveridge curve are associated with changes in cyclical unemployment.

Job Separation and Vacancy Matching

Now, as mentioned above, modern adaptations of the model focus on flows of vacancies and unemployment rather than stocks. These variables are in constant flux and never settled and so the flow concept works better. It also leads us to realize that one of the key metrics to think about is the 'matching' of unemployed people to the existing job opening rate, and the 'separation rate' of workers from their jobs.

The range of factors that can influence the vacancy matching process (i.e. the prevailing rate of unemployment) is extensive, and there has been plenty of research done to try and estimate the most important types that have affected real world unemployment rates over recent decades. The most important of these include:

- Wage Rates - since higher wages will encourage workers to accept more jobs.

- Generosity of Unemployment Benefits - will discourage workers to accept jobs.

- Productivity Growth - will usually increase demand for workers.

- The Real Interest Rate of Savings/Assets - increases income from non-work.

- Employment Protection Laws - may deter firms from recruiting.

- Barriers to Labor Mobility - prevent workers from taking jobs.

- Labor Market Policies - may help to increase job take up.

- Labor Taxes on employers - make recruitment more expensive.

- Labor Taxes on employees - make work less rewarding.

- Terms of Trade with foreign countries - increase or decrease demand for workers via changes in demand for domestic goods/services.

The list goes on, but I think you can see that there are lots of factors at play here.

The inclusion of wage rates in the list is a little controversial since it is not independent of the other factors, and will in large part be determined by those other factors in the same way that unemployment is determined by them.

When the separation rate and/or job matching process results in a greater or lesser number of people in employment relative to the number of vacancies that exist, there will be a shift of the Beveridge curve, as discussed below.

Economic lessons from Beveridge Curve shift analysis

With the observed unemployment rates since the 1960s shifting significantly through the 1980s and into the 1990s and beyond, much of the economic research into the Beveridge curve has centered around estimating the influence of the factors listed above. The PDF research papers linked to below will be of interest to anyone who wishes to look into that, but for now I want to illustrate what happens when the separation rate and the vacancy matching rate changes.

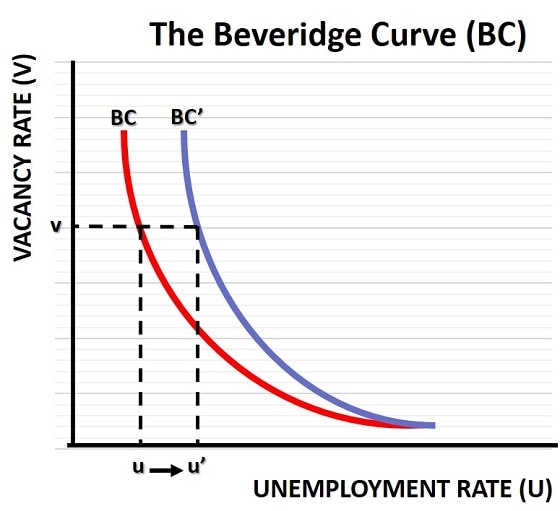

In the graph below I've drawn a Beveridge curve shift from BC to BC'. This sort of shift will occur anytime that people enter unemployment faster, or fill vacancies at a slower rate, due to one 'economic shock' or another. In the 1980s this happened due to the extensive deindustrialization that occurred in many western economies at that time.

The problem with deindustrialization is that, as manufacturing jobs are lost, even if there is a full compensating effect of growth in service industry jobs (there wasn't full compensation, but lets just suppose so for simplicity) there will be a resulting mismatch between the skills that redundant workers have, and those that employers need. The effect of this is to slowdown the vacancy matching process, causing a rightward shift of the Beveridge curve as shown above.

Starting with an unemployment rate of u and a vacancy rate of v, the original Beveridge curve predicts economic stability given the existing vacancy matching rate. However, after deindustrialization leads to a skills mismatch, a slower matching process results that leads to a new curve at BC'. Given the existing flow of vacancies (which we continue to assume is constant) we reach a new, higher level of unemployment at u'.

Beveridge curve shifts of this sort can be thought of as occurring due to structural unemployment changes, rather than the cyclical changes which are represented as movement along the original BC curve.

Depending on the severity of the structural unemployment and its underlying causes, the higher unemployment may persist for years or even decades. Of course, the severity and duration of the extra unemployment will depend in part on whether or not the government takes appropriate action to influence those factors listed above over which it has control e.g. unemployment benefit generosity, labor taxes, labor market policies and so on.

Labor Market relationship to the NAIRU & Phillips Curve

The value of the Beveridge curve comes from its extra appreciation of the factors that drive both cyclical and structural unemployment. The NAIRU model uses expectations-augmented Phillips curve analysis to focus on the effects on unemployment that result from changes in the business cycle, and on ill-advised short-run government demand-management policies that aim to reduce unemployment without considering the effects on inflation.

The NAIRU actually has very little to say about what determines the long-run rate of unemployment, or natural rate of unemployment, which is where the Beveridge curve has something more to offer.

Conversely, the Beveridge curve has little to say about inflation, or the consequences of short-run interventions in the economy with respect to its impact on prices. In this model we simply assume that the government pursues a policy of low and stable inflation.

Ideally, a single unified model that can account for changes in the different types of unemployment would be available, but at present it is not. Work is underway to try and produce such a model, but right now that is beyond the frontier of current economic knowledge.

Sources:

- S. Nickell, Et al. - The Beveridge Curve, Unemployment & Wages (PDF)

- OECD - Beveridge Curve Survey (PDF)

- W. T. Dickens - The Labor Market and the Phillips Curve (PDF)

Related Pages: