- Home

- Business Cycle

- Balanced Budget Multiplier

Balanced Budget Multiplier, Explained (with Graphs & Example)

The balanced budget multiplier concept arises from John Maynard Keynes' general theory, and it relates to the aggregate impact on national income/output of an equal increase in both government spending and taxation.

On first inspection we might expect that there would be no overall impact on output from this sort of policy, with spending and tax increases cancelling each other out, but this overlooks the multiplier effect.

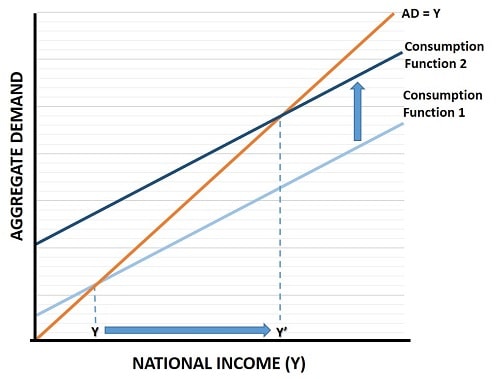

Using the graph below, which is taken from my page about the Consumption Function (click the link for an explanation of the graph), we can see an illustration of what happens to national income when consumption is boosted by an increase in government spending.

A relatively small increase in government spending, as illustrated by the small upward arrow from Consumption Function 1 to Consumption Function 2, yields a larger increase in national income, as illustrated by the large horizontal arrow.

The reason for this becomes intuitively obvious when we recall that national income is equal to total expenditure (spending) in the economy, and that consumers do not spend all of their income, they save a portion of it. Therefore, when taxes are raised by a given amount in order to increase government spending by an equal amount, overall spending will be higher in the economy because the government does not save any of the increased taxes that it receives.

Simple Spending Multipliers - An Example

To explain this with an example, if Jack has $4,000 per month of disposable income each month and chooses to spend 80% of it, his spending is $3,200. Now, when the government raises taxes from Jack by an amount, lets say $400 dollars, Jack now has only $3,600 of disposable income of which he spends 80% i.e. $2,880. The government then increases its own spending by the $400 it collected from Jack, so that overall spending in the economy is now $3,280 ($80 more than before the change).

The increase in spending has come at the expense of the saving that Jack would have done had he not been taxed more.

|IMPORTANT| The idea continues with the initial change of $80 of spending being just the first round. The Keynesian Multiplier effect will generate a larger change once the full impact has worked through the system.

For many of our Keynesian economist friends, in government policy making circles, the analysis stops with the increased national income brought about by the extra overall spending. However, for anyone who cares about the long-term growth rate of the economy there should be immediate cause for concern, because a lower saving sate in the economy will ultimately lead to reduced investment, slower growth, and a smaller level of national income, as explained in my article about Endogenous Growth Theory.

The Balanced Budget Multiplier uses the same line of reasoning as the general spending multiplier presented above, but it looks at the particular circumstance of a government budget being in neither a deficit nor a surplus, i.e. where the economy generates the same amount of taxation as the government spends. It then shows how national income can be increased by the full amount of any change in tax & spending.

The Budget Surplus Line

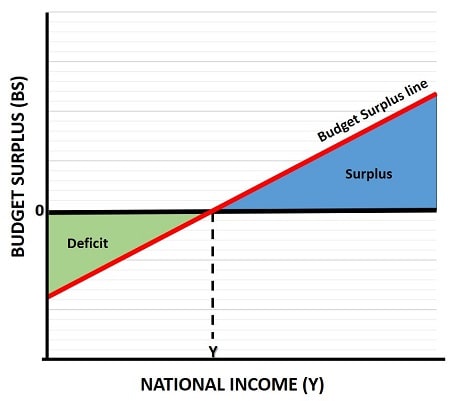

To explain the balanced budget multiplier we first need to understand a little about budget surpluses and deficits. In the budget surplus graph above I've drawn the upward sloping budget surplus line in red. The black horizontal line is drawn to illustrate a balanced budget i.e. it's value is zero, neither negative nor positive.

At the intersection of these two lines we have the level of national income for which the amount of taxes raised is equal to the amount of government spending on goods and services plus transfers for welfare payments, pensions and so on.

The point to note here is that the budget isn't often completely balanced, and whilst we usually assume that this is because of the government spending too much and driving us into a deficit, it can actually result from any other factor that reduces national income e.g. a drop in business confidence leading to less investment spending.

In reality, most western governments (especially the US and UK) have spent most of the last few decades in a virtually endless deficit precisely because of excessive government spending, but it's important to note that these things do vary of their own accord too.

In the graph, any income level below Y will come with a deficit because the amount of taxes raised will be lower and unemployment will be higher (meaning extra expense on transfer payments for welfare checks and so on). To the right of Y, unemployment levels are lower and taxes raised are higher, so a budget surplus results.

Politicians sometimes talk about the full-employment budget surplus, meaning that they want to target a level of spending such that in times of full employment there will be a small surplus. This is used as a way of justifying a deficit in times when unemployment levels are seen as being too high.

Calculating the Balanced Budget Multiplier

The idea of the balanced budget multiplier is to show that a change in government spending, funded by an equal change in taxation, will lead to an overall change in economic income equal in size to the increase/decrease in government spending.

So, continuing the analysis from above where an $80 increase in income resulted after the first round of spending, following a $400 increase in taxes and government spending, the balanced budget multiplier shows that once the full multiplier effect has worked through the system, national income will rise by exactly $400.

The algebra involved in demonstrating this is a little confusing, but if you want to punish yourself then you can work through it on Wikipedia's page about the balanced budget multiplier. In fairness it's not overly difficult if you understand the formulas and how to transpose them.

The problem with this Keynesian nonsense is that in order to prove this you need to hold too many other variables constant, variables that absolutely are not constant. The balanced budget multiplier suffers from a similar static analysis problem to the paradox of thrift in that it fails to account for resulting dynamic changes in interest rates, saving rates, and investment rates that are caused by changes to the composition of national income.

For those Keynesians who place their faith in the balanced budget multiplier and its conclusion that national income can be increased by x-amount by taxing people by x-amount and having our governments spend it for us, I have to ask why we don't have those governments tax all of our money, and spend all of it for us?

That way we should get maximum national income levels... except of course that this has been tried before many times in the form of socialism, with invariable total failure in the form of catastrophic economic collapse!

Related Pages:

- The Consumption Function

- The Keynesian Multiplier

- Crowding Out

- Aggregate Demand

- Cyclical Unemployment

- The Business Cycle

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

Bank Reserves, Asset Inflation, and the Risk of Future Price Inflation

Dec 19, 25 04:16 AM

Learn what bank reserves are, how they affect asset prices, and why future reserve creation could lead to inflation through commodities and currencies. -

Credit Creation Theory; How Money Is Actually Created

Dec 16, 25 03:07 PM

Explore how modern banks create money through credit creation, why the money multiplier fails, and the role of central banks and reserves. -

U.S. Industrial Policy & The Unfortunate Sacrifice that Must be Made

Dec 12, 25 03:03 AM

U.S. Industrial Policy now demands a costly tradeoff, forcing America to rebuild its industry while sacrificing bond values, pensions, and the cost of living. -

The Global Currency Reset and the End of Monetary Illusion

Dec 07, 25 03:48 AM

The global currency reset is coming. Learn why debt, inflation, and history’s warnings point to a looming transformation of the world’s financial system. -

Energy Economics and the Slow Unraveling of the Modern West

Dec 06, 25 05:18 AM

Energy economics is reshaping global power as the West faces decline. Explore how energy, geopolitics, and resource realities drive the unfolding crisis.