- Home

- Supply-Side

- Bullwhip Effect

The Bullwhip Effect in Supply Chain Output Explained

The Bullwhip Effect in supply chain output is a concept popularized by Michael Burry in his outlook for western economies in the post-globalism era. At its heart, the bullwhip effect is a simple idea that illustrates how the global supply chain can go through stages of rapid growth and decline as producers react to fluctuations in demand for their products.

Traditionally, the bullwhip effect was used to describe how a particular industry would undergo this growth-contraction process, but Burry has applied the same principle to the economy as a whole.

In the sections below I will give an example of how the bullwhip effect impacts the supply chain, how it starts with a temporary increase in demand from consumers that then sends signals to producers to oversupply, with inventory build ups that then cause a sharp contraction in production.

Bullwhip Effect Example

If you haven't already guessed, the bullwhip effect gets its name because of the wave that travels through a whip as it is swung up and down.

The best example of a supply chain bullwhip effect may be playing out right now. All across the world in 2020, government responses to the Covid-19 pandemic were to force their populations into lockdowns that would last months or years.

Without getting into the medical reasons given to justify these lockdowns, the economic effect was to prevent workers from being able to produce goods and services, and many global supply chains collapsed as a result. At the same time that supply was collapsing, governments issued enormous stimulus checks so that people would continue to spend money.

The problem with those stimulus checks is that they are temporary, and they cannot increase productivity. They can only cause a temporary boom followed by a bust, and with inflation at 40 year highs it is not feasible to keep printing more money - that path has been tried before, and it simply leads to hyperinflation.

Bullwhip Effect on Inflation

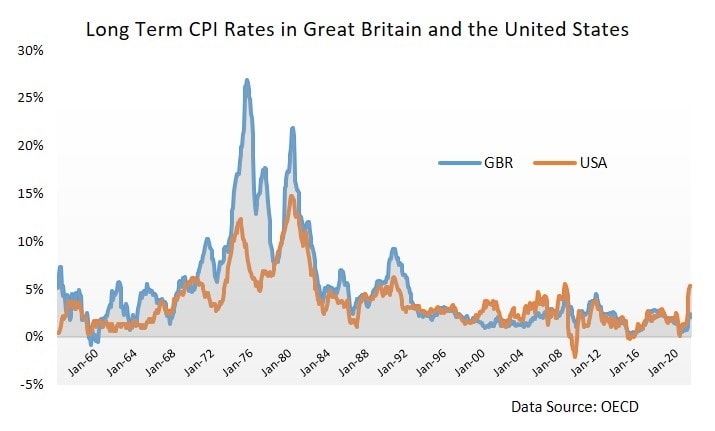

As anyone with even the most basic understanding of economics could easily predict, the huge fall in supply resulting from the lockdowns combined with the huge stimulus to demand from all the free money that was sent people, went on to cause prices to rise. From late 2021, with inflation rising from a starting point of about 2% all the way up to double digits by late 2022, the global economy found itself sitting on the precipice of a major economic collapse.

The Federal Reserve, and the government, insisted that such price rises were 'transitory', until they clearly were not. Then they insisted that they had peaked, then they looked for scapegoats, and then they started raising interest rates. By late 2022, inflation (as measured by the CPI) had exceeded 10% in some countries, with the economic outlook predicting severe recessions and the sharpest falls in living standards on record.

Whilst a basic understanding of economics would have enabled firms to predict the coming inflation, most of them chose instead to listen to the Federal Reserve and the irresponsible government, with their foolish claims that the economy would quickly rebound. They were convinced by that foolishness when the lockdowns were lifted because they looked at the demand for their products, which was sky high as consumers eagerly spent their stimulus checks on all manner of products once they were allowed out of the homes.

The Bullwhip Effect on Inflation was clearly significant in the 1970s and 1980s.

The Bullwhip Effect on Inflation was clearly significant in the 1970s and 1980s.Retail shop sales grew quickly, causing them to lodge larger orders with suppliers. Those suppliers then increased their production by a multiple of that increase, because they anticipate future demand not just on current demand but also on the trend, and the trend was for even greater demand in future. This process continued for over a year, but the latest figures suggest that demand is now falling sharply. This is further supported by a huge build up in inventory throughout the economy, as the supply chain has been slow to react to falling demand.

The problem is that pent-up demand fueled by stimulus checks is not sustainable. When it drops, as it appears to be doing in late 2022, the supply chain will contract sharply and we will witness the bullwhip effect as producers cut production and prices to reduce their inventory build up. We can expect unemployment to rise sharply because of this, and there may well be some slowdown in inflation similar to what happened in the 1970s and 1980s (see graph above).

Ultimately, however, a flood of stimulus measures will no follow any increase in unemployment levels. In so doing, the next inflationary cycle is stimulated.

Even as I publish this report, the mainstream media fail to report the true extent of the economic collapse that is coming. In the BBC link below, the economic forecasts of rising unemployment and an inflation peak, with an albeit 'record drop' in living standards, all understate what looks to be coming.

So, I'll make my own prediction, and that is that 2023 will be worse than the reported BBC prediction, and that far from improving after 2023, things will further deteriorate.

The Galloping inflation illustrated in the graph above may or may not materialize in the years ahead, but if it doesn't it will only be because sky-high inflation persists, or gets worse, without any significant dips in the coming years.

Bullwhip Effect Causes and Solutions

The causes of the bullwhip effect may be many and varied, but ultimately they all serve to pass false signals to producers that first encourage them to oversupply goods and services to the economy, and then rapidly reduce supply.

What Causes the Bullwhip Effect?

The key to understanding what causes the bullwhip effect is that supply chain reactions occur for relatively simple reasons i.e., when firms experience growing demand for the products they will react by increasing production (and prices) regardless of economic forecasts.

Economic forecasting is known to be extremely difficult and unreliable, and in many cases the most authoritative institutions such as the Federal Reserve routinely get it completely wrong. Most business leaders will not listen to a relatively fringe group of more reasonable economists when they predict economic problems if the Federal Reserve and the Government contradict them.

At the start of this mess, Fed Chair Jerome Powell insisted that he was not even 'thinking about thinking about raising interest rates'. When inflation appeared he declared it transitory. Then he said it had peaked. Now he says that controlling it is his primary concern, and he has had to increase interest rates at the fastest rate ever! The incompetence is staggering.

Even as I write this report, President Joe Biden insists that the economy is 'on fire'!

Most US firms have simply reacted to strong demand by increasing production even faster. Most sensible economists are now predicting recession as the bullwhip effect on the supply chain is expected to head south very soon.

If the government then reacts to this with another round of excessive fiscal stimulus, and the Fed reacts with excessive interest rate cuts and money-printing, then demand may once again bounce upwards causing another excessive increase in production and another wave in the bullwhip effect but, as I said above, ultimately this nonsense cannot fix the problem and will only make the eventual collapse even worse.

How to Reduce the Bullwhip Effect

At the level of macroeconomic mismanagement by the government and the Federal Reserve it will, of course, be difficult for firms to second guess what they are being told by the so-called experts. Business leaders are not economists, and they need to put their faith somewhere, even if it is misplaced.

This does not mean that firms are powerless to reduce the bullwhip effect. Since much of the problem with oversupply occurs when information from retailers shows an increasing trend in sales, a system of better information sharing between retailers and manufacturers/suppliers would allow for more accurate forecasting of demand in future, and prevent at least some of the supply chain inventory build up when demand turns out to less than simple trend forecasting would suggest.

All that is required here is that retailers immediately inform their suppliers of lower anticipated orders in future as soon as they see falling sales. Electronic Data Interchange technology with increased frequency 'Computer Assisted Ordering' has already been implemented in some industries for precisely this purpose, because it is more efficient than infrequent large 'batch ordering'.

In other industries, there is a 'Vendor Managed Inventory' system in place or a 'Continuous Replenishment Program' that allows suppliers to take control of restocking rather than wait for the retailer to place an order. Vendor machines in retail outlets are an obvious example of this, but the practice has been extended to many other industries. The use of third-party logistics firms to coordinate the greater complexity and frequency of deliveries, with a much more diverse range of resupply items all on the same delivery truck, creates greater economies of scale via the division of labor principle.

These, and other methods of reducing the bullwhip effect, are discussed in the paper by H. L. Lee linked to below.

Sources:

- H. L. Lee - The Bullwhip Effect in Supply Chains (PDF)

- BBC News - UK faces biggest fall in living standards on record

- OECD - Long Term CPI Rates

Related Pages:

- Pent Up Demand

- Inflation vs Deflation

- Galloping Inflation

- Supply Side Economics

- What is Inflation, and why is it Bad?

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

Bank Reserves, Asset Inflation, and the Risk of Future Price Inflation

Dec 19, 25 04:16 AM

Learn what bank reserves are, how they affect asset prices, and why future reserve creation could lead to inflation through commodities and currencies. -

Credit Creation Theory; How Money Is Actually Created

Dec 16, 25 03:07 PM

Explore how modern banks create money through credit creation, why the money multiplier fails, and the role of central banks and reserves. -

U.S. Industrial Policy & The Unfortunate Sacrifice that Must be Made

Dec 12, 25 03:03 AM

U.S. Industrial Policy now demands a costly tradeoff, forcing America to rebuild its industry while sacrificing bond values, pensions, and the cost of living. -

The Global Currency Reset and the End of Monetary Illusion

Dec 07, 25 03:48 AM

The global currency reset is coming. Learn why debt, inflation, and history’s warnings point to a looming transformation of the world’s financial system. -

Energy Economics and the Slow Unraveling of the Modern West

Dec 06, 25 05:18 AM

Energy economics is reshaping global power as the West faces decline. Explore how energy, geopolitics, and resource realities drive the unfolding crisis.