- Home

- Aggregate Demand

- AD-AS Model

The AD-AS Model Explained

The AD-AS Model is one of the first models that students of macroeconomics will come across. It offers a clear and simple framework for understanding how the output level in the economy (and the employment levels needed to produce that output) varies with the price level.

The driving forces are, as usual, supply and demand. However, in macroeconomics we are concerned with aggregate supply and aggregate demand, and we should be careful to understand these concepts properly before proceeding (see the links below for explanation).

Whilst the conceptual framework is simple, the exact process by which the economy moves to its new equilibrium output and price level is not well explained in standard text books, because the actual AD and AS curves are derived from two completely different economic models that don't actually fit together very well.

Anyone who is familiar with the standard supply and demand model for individual products should not make the rookie mistake of thinking that the simple dynamics in that model can be applied here.

This can be a problem if a fully logical and consistent explanation of how these curves interact is needed, and this is a topic of some debate at the highest level of academia, but without getting bogged down in that debate lets just say that the AD curve is derived from the IS-LM model whereas the AS curve comes from the Labor Market Theory of Output.

However, I will grant that whatever the precise mechanism of change, it is not controversial to agree that a boost to aggregate demand will generate a higher output and price level. Click here for a scholarly explanation.

AD-AS Graph

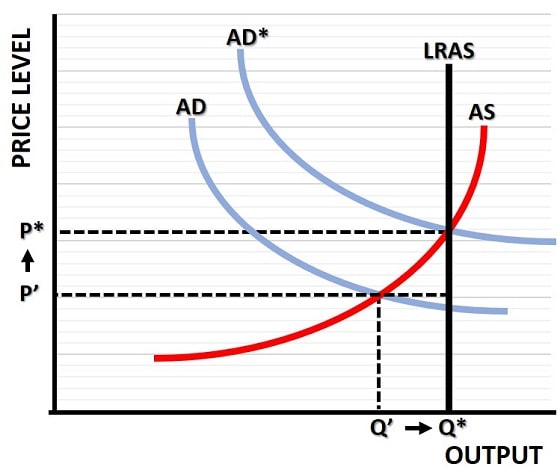

You might wonder why the long run aggregate supply curve is a vertical line, the reason is because there is only one level of output at any given time that equates to maximum sustainable output, and this output level is held to be independent of the price level.

Now, you could argue that in a period of hyperinflation and constantly rising price levels that there is such inefficiency in the economy that the maximum sustainable output level would decrease at higher price levels. You would be right, but it would be an unfair criticism.

Economic models are always just simplifications of reality that are used to highlight a few key points. The AD-AS model is no different and its purpose is just to illustrate how the forces of supply and demand interact to drive output, employment/unemployment, and prices.

You may wonder why the AS curve reaches beyond the LRAS curve. This is because it is possible for an economy to produce output beyond the maximum sustainable level, but it can only do this temporarily. For example, if all workers were working excessive overtime that they would eventually tire of.

Objections to the AD-AS Model

The main objection that I, and other critics of mainstream economics, have with the AD-AS Model is the fact that its very purpose is to illustrate the positive effects of a well-executed demand-management policy when real examples of such policies are as rare as fairy dust.

In the AD-AS graph above, even if the government was able to accurately assess the current state of the economy and thereby produce the curves as illustrated, it would require a degree of precision beyond human capability to accurately forecast where those curves would be at some future point in time so that it can calculate how much of a stimulus is required to shift the AD curve from AD' to AD*.

In other words, this doesn't all just happen after a government committee meeting where the appointed members throw this lever, turn that dial, press the right button and voila - mission accomplished! No, in reality, all this plays out over an extended period of time during which the real aggregate demand and supply levels are constantly shifting of their own accord.

It's actually very difficult to know precisely where the AD or AS curves lie at any given moment, because all economic data is gathered retrospectively with a significant time-lag of several months.

Similarly, any stimulus will have another significant time-lag before it actually takes effect, by which time the curves may have self-corrected and moved to an optimal LRAS intersection. In that event the stimulus would actually cause an over-expansion of the output level by the time it took effect.

For anyone who believes that the government has the wits to overcome these difficulties, I can only imagine that you have never actually worked in a bureaucratic public sector organization!

By way of example, consider how accurately our economic masters had assessed the positions of our economies in the run up to the 2008 financial meltdown, the biggest credit fueled boom & boost in living memory. For years prior to the crash, and right up to the final moments before it, our central banks had been running historically low interest rates... among other things this has the effect of further expanding lines of credit!

These 'experts' did this because they were totally oblivious to the enormous over-expansion that they had already allowed to develop, and these are the people who are entrusted to accurately apply an active demand-management policy...

I put it to you that government simply does not have the required level of competence for such things.

Given the difficulty involved in knowing exactly how an economy is performing, and the near impossibility of predicting where it will be at some point in future, the practical application of demand-management policy is fraught with potential errors, and most supply-side economists agree that such maneuvers are as likely to destabilize an economy as they are to helpfully assist it.

The AD-AS Model does set an interesting and useful framework for analysis, but it should not be used as a justification of government interference in the economy given its track record with such endeavors.

Sources:

Related Pages:

- Aggregate Demand

- Aggregate Supply

- The IS-LM Model

- The Crowding Out Effect

- The Consumption Function

- The Keynesian Multiplier

- Cyclical Unemployment

- The Natural Rate of Unemployment

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

Bank Reserves, Asset Inflation, and the Risk of Future Price Inflation

Dec 19, 25 04:16 AM

Learn what bank reserves are, how they affect asset prices, and why future reserve creation could lead to inflation through commodities and currencies. -

Credit Creation Theory; How Money Is Actually Created

Dec 16, 25 03:07 PM

Explore how modern banks create money through credit creation, why the money multiplier fails, and the role of central banks and reserves. -

U.S. Industrial Policy & The Unfortunate Sacrifice that Must be Made

Dec 12, 25 03:03 AM

U.S. Industrial Policy now demands a costly tradeoff, forcing America to rebuild its industry while sacrificing bond values, pensions, and the cost of living. -

The Global Currency Reset and the End of Monetary Illusion

Dec 07, 25 03:48 AM

The global currency reset is coming. Learn why debt, inflation, and history’s warnings point to a looming transformation of the world’s financial system. -

Energy Economics and the Slow Unraveling of the Modern West

Dec 06, 25 05:18 AM

Energy economics is reshaping global power as the West faces decline. Explore how energy, geopolitics, and resource realities drive the unfolding crisis.