The Economics of Western Decline

The study of economics is a rich and rewarding experience, and whilst some regard it as the dismal science I can only assume that they are referring to the dismal performance of our political masters over recent decades, in terms of their truly awful economic policy track-record.

There is barely a developed country in the world today that is not mired in debt the likes of which we have never seen in peacetime history. There are, of course, many reasons and arguments that can be made to justify these debts, but the simple fact of the matter is that it is politics, not economic science, that has brought us to the precipice of a new economic catastrophe.

Our most recent experience of government induced recession came in 2008, and while the years of hardship that followed were both deep and prolonged, there is a real danger that what comes next for the developed world, including the United States, will make those years seem like our glory days.

For the first time in 50 years there is the real prospect of stagflation ahead of us - a period of both high unemployment and high inflation. Modern mainstream economic theory and research, dominated as it is by Keynesian economics, still struggles to explain such things.

We have already had a taste of higher inflation, but that may turn out to have been nothing more than a mild first wave of what will become a much bigger problem. In 2025, recession has already emerged in Japan, Germany, and the UK, but high inflation lingers on.

If a country suffering from recession were to try to stimulate its economy with yet more government deficit-spending, at a time of unprecedented debt levels, the end result could drive inflation much higher, even as its economy sinks further into recession.

Unfortunately for the western world, public policy has become complicated by a literal kaleidoscope of existential threats to the current economic system, and I will detail these threats in a section below.

Before that, I want to start with an overview of the typical core undergraduate program that economics students will need to understand, and the helpful content that my site has to offer in this regard.

Macroeconomics

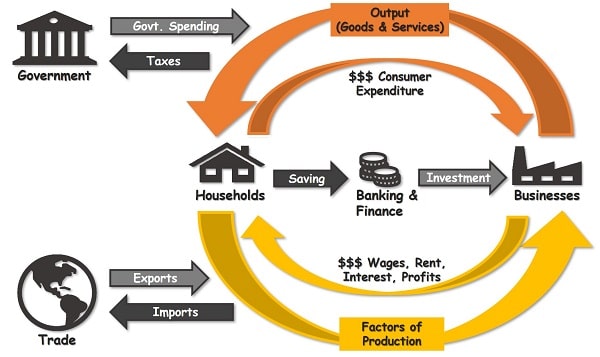

- The Circular Flow Model – The starting point for an overview of macroeconomics and the circulation of income, expenditure, inputs, and output.

- The Business Cycle – The best starting point for understanding instability in the economy and competing theories around what, if anything, to do about it.

- Inflation – A persistently rising price level is one of the two biggest problems that can occur in macroeconomics, and it often relates to the business cycle.

- Unemployment – The second major problem occurs when a growing percentage of workers are unable to get work, and it also relates to the business cycle.

- Banking – The banking system is given special attention in macroeconomics because it can have a very destabilizing economic impact in certain circumstances.

- Monetary Policy – One of the two major policy instruments for active management of the business cycle is control of interest rates and money.

- Aggregate Demand – Demand management is the second major policy instrument for active management of the business cycle.

- Supply-Side Economics – This focuses on policies to promote the productive capacity of the economy by reforming taxes and cutting unnecessary regulations.

- Foreign Trade – This introduces international economics & the global economy, and the impact of imports, exports, capital flows and exchange rates.

Microeconomics

- Consumers – Understanding consumer behavior in the marketplace is one of the two most important concepts in the field of microeconomics.

- Production – Understanding producer behavior is the second of the two most important concepts in microeconomic theory.

- Perfect Competition – competitive markets are the ideal market structure for achieving efficiency for both consumers and producers.

- Monopolistic Competition – Monopolistic competition and other sub-optimal market structures introduce the concept of deadweight loss in economics.

- Game Theory – This introduces a more advanced analysis of how firms behave in a strategic context, where competitor behavior must be considered.

- Economies of Scale – Economies of scale for firms and industries are an important determinant of economic efficiency.

- Market Failure – All markets in the real-world entail a degree of failure i.e., imperfection, but some require corrective action or even nationalization.

These topics in microeconomics and macroeconomics form the core components of a typical undergraduate program, and I’ve written them without any unnecessary technical jargon or mathematics. There is, of course, a great deal of mathematics in any economics degree course but my site is focused on helping readers to understand the concepts rather than the numbers.

Economics and economic research are often criticized for their sometimes-misguided over-reliance on mathematical techniques that are not well-suited to the social sciences. The math used is better suited to the hard sciences like physics. Unfortunately, there is no economics faculty that I am aware of that spares its students from this pain! Happily, math is not needed at all if you are a more casual student with just a general interest in economics.

I have focused my site on the core components of economics, but there are many more specialized applied economics courses that flow from the core topics. Industrial Organization, International Economics, Economic Development and Financial Economics were my own chosen options, but there are many more applied economics courses to choose from. Usually these are the focus of final year undergraduate courses.

There is no material on my site aimed at complementing a graduate program in economics, though my site does offer a useful refresher for graduate students to brush up on the key concepts. There is also plenty of supplemental content, economic analysis, and opinion pieces on the economics news of the day, particularly with respect to the existential threats that the western economies are faced with in modern times.

Existential Threats to the Economic System

The US Federal Debt Burden

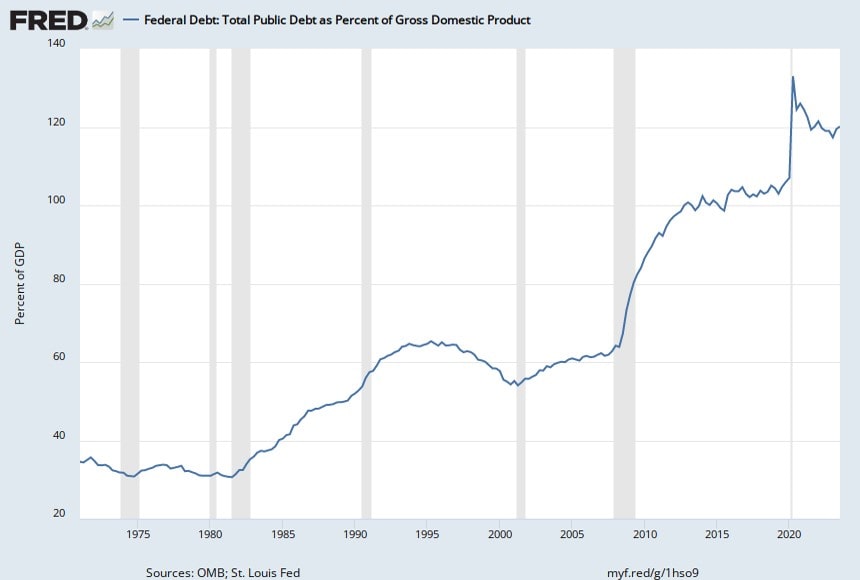

As the graph below illustrates, the US Debt to GDP (Gross Domestic Product is a measure of national income) has been trending higher for decades. There had, until recently, been the insane idea that debts don’t matter since money can always be printed with which to repay those debts. That idea fell flat on its face when, in 2020, inflation began to rise sharply thereby demonstrating that the link between the money-supply and inflation is still relevant today (some economists had argued that the link was no longer valid).

The starting point for the data series below is January 1971, as this was the year that president Nixon took the US dollar off the fixed dollar-to-gold conversion rate, meaning that our current fully-fiat monetary system started at that time. The vertical grey lines represent periods of recession.

As can be seen, it wasn’t until the early 1980s

recession that debt to GDP began its long march higher. The gradual rise in

debt from the early 1980s to the mid-1990s coincides with the

deindustrialization of much of the western world, with huge numbers of job

losses in the manufacturing sector, and higher resulting welfare claims as

unemployment rates soared and the inequality between rich and poor widened.

Another consequence of manufacturing decline was the opening up of a large

trade deficit, a deficit that was plugged largely by increased international

borrowing i.e. more debt.

From the late 1990s until the dot com recession of the early 2000s, debt came down somewhat, but then resumed its climb. The early 2000s was the start of a long period of low interest rates, making debt cheap, and encouraging more and more borrowing.

The 2008 financial crisis led to massive borrowing and deficit spending by the government in order to fund huge bailout packages for the insolvent banking sector. The banks had made excessive mortgage-backed loans off the back of a real estate bubble that had burst by 2008. An almost continuous 14-year period of ZIRP (zero interest rate policy or close to zero) followed the crisis, because the level of indebtedness in the system was already too high to afford realistic interest rates. As a result of ZIRP, the debt continued to surge ever higher.

The Covid pandemic of 2020 then saw another massive surge in government borrowing in order to fund stimulus checks during the lockdowns, meaning that debt rose sharply yet again. The latest figures show that the debt currently stands at around 120% of GDP.

Unfunded Liabilities, Energy Costs, and Trade

If the current GDP to debt ratio is alarming, it pales in comparison to the nightmarish level of expenses that will emerge in the coming 10-20 years. These costs fall into three main categories:

Demographic Change & Unfunded Liabilities – Demographic change refers to the changing composition of the population in terms of dependents to working-age people. With half of the baby boomer generation already retired, the next 15 years will see the other half retire, and the first half reach nursing home age. The cost of this comes in terms of social security payments and healthcare costs. These are termed ‘unfunded liabilities’, and Jeff Gundlach estimates that these amount to around $200 trillion – more than six times as large as the federal debt at the time of writing, and I’ve never seen a sensible plan about how to deal with this enormous expense.

Energy & Environmental Costs – Commitments to net-zero carbon emissions amount to a commitment to much more expensive energy in future. The only exception to this outcome would require a commitment to thousands of nuclear power stations located all over the western world, because small modular reactors are actually ultra cheap, clean, and safe. Unfortunately, the nuclear power industry has a terrible publicist, and seems unlikely to be embraced anytime soon. The implication, as cheap oil and gas is gradually replaced by expensive renewable energy, the costs of production will soar and inflation/recession is the likely outcome.

Trade in a De-Globalized World – The benefits of ‘globalization’ over the past few decades brought an almost endless supply of cheap manufactured goods to domestic consumers, thereby boosting consumer spending courtesy of the almost inexhaustible supply of cheap labor in China and elsewhere in the developing world. Going forward, and in the wake of the 2020-21 global pandemic lockdowns, the strategic problems arising from globalized supply-chains are leading to a reversal of the globalization trend. This should, of course, bring some jobs back to western nations, but it will also mean more expensive products in future i.e. more price inflation.

Higher Interest Rates & Finance Costs

The problem is not just the sheer size of the debt and the coming expenses, there is also the problem of rising interest rates. Rates that had been near zero for over a decade could no longer be held at these artificially low levels after inflation shot higher in the wake of the global lockdowns. The lockdowns had created severe supply shortages in the marketplace, leading to rapid price increases. Additionally, hefty stimulus checks and money-printing added further fuel to the inflation fire.

The Federal Reserve was then forced to sharply raise interest rates to dampen demand and cool down inflationary pressure.

Going into 2026, it may seem that inflation is now under control (having been much reduced from its peak in 2022), and that interest rates can therefore start to come down again. That indeed is anticipated by many market investors, however, there are also many signs that inflation could easily return if rates are reduced too soon.

The government is still deficit-spending at extremely high levels, and without some measure of fiscal restraint there is less chance of any significant interest rate reduction. There is also a good argument to be made that all the money-supply growth in recent years has not yet fully played out, meaning that inflation could easily start to rise again.

The problem with higher interest rates is that it makes debt-servicing much more expensive. Servicing costs are now already larger than the entire national defense budget, and they are set to climb out of all control in the near future as existing debt is gradually refinanced into higher-rate debt.

In Summary

The cost of all the existing debt, and all the future strains on the public finances, could easily lead to a US debt crisis. If a debt crisis does emerge, it would leave the US and other western countries with two options:

- Defaulting on the debt leading to a financial crisis that breaks the bond market, destroying pensions and savings, widening the inequality between rich and poor, and creating a deflationary recession.

- Debasing the currency via money-printing to nominally pay the debts, thereby creating sky-high inflation that again destroys the bond market and associated pensions and savings. This would create an inflationary recession.

Both options would lead to the deepest and longest economic depression since the 1930s, and the US dollar would certainly lose its reserve currency status, meaning that a new global financial system would be required. Whatever new system is created, it is hard to see how the western economies could emerge with strong national currencies and favorable terms for international trade with the rest of the world.

There is a danger that voters will blame the recession on capitalism, but the truth is that incompetent, and corrupt, government excess is to blame. If voters react by voting for socialism, then the consequences will be horrendous. More government is never the solution to bad government.

The coming collapse may herald a real shift in global economic power, meaning relative economic decline for the western economies, and significant growth in the East – primarily Russia, India, China, and Southeast Asia.

FAQs that People Ask

What is the main economic problem?

The main economic problem, often referred to as the fundamental economic problem, is the issue of scarcity. Scarcity arises because resources (including time, money, labor, and natural resources) are limited, while human wants and needs are virtually unlimited.

This gives rise to three basic economics questions:

- What to Produce - Given limited resources, societies must decide which goods and services to produce. Choices need to be made about allocating resources to different industries and sectors.

- How to Produce - Once the decision on what to produce is made, societies must determine the most efficient and effective ways to produce those goods and services. This involves choices about technology, production methods, and resource utilization.

- For Whom to Produce - Distribution is a critical aspect. Societies must decide how the goods and services produced are distributed among the population. This involves questions of income distribution and access to resources.

What are the three main types of

economic systems?

The three main types of economic systems in the modern world are:

- Market Economy (Capitalism) - In a market economy, decisions over what, how, and for whom to produce are driven by the forces of supply and demand in the marketplace. Private individuals and businesses own and control the means of production, prices are determined by the interaction of buyers and sellers, and the government's role is usually limited to enforcing contracts and protecting property rights.

- Command Economy (Communism/Socialism) - In a command economy, the government or a central authority makes all economic decisions. The state owns or controls the means of production, and resources are allocated based on central planning. Prices are often set by the government, and the goal is to give people a better level of social & economic equality. However, it usually suffers from a huge loss of efficiency.

- Mixed Economy - A mixed economy combines elements of both market and command economies. It allows for private ownership and market forces to operate, but the government also intervenes in certain areas to regulate and address market failures. Governments in mixed economies provide public goods, social services, and regulations to obtain better outcomes in particular areas in which free-markets fail to deliver satisfactory outcomes.

In reality, all economies are of the mixed variety because all contain some measure of both market economy and command economy, but to varying extents.

What is positive and normative

economics?

Positive economics and normative economics are two distinct branches within the field of economics that serve different purposes and involve different types of analysis.

Positive economics is concerned with objective analysis, describing and explaining economic phenomena as they are. It deals with facts, data, and observable economic evidence. It is value-free and focuses on what is, rather than what ought to be.

Normative economics, on the other hand, is concerned with subjective analysis, involving people making judgments about what ought to be or what is desirable. Clearly this involves value judgments and opinions about what is considered good, fair, or just.

Is an economics degree hard?

Generally, an economics degree is considered to be quite difficult due to its analytical nature and use of mathematics. Of course, for a student who excels in that type of challenge then it is much less difficult, but I recall several students who had taken some economics courses as part of their degrees, and they all struggled!

Economics is unlike some courses where a cursory effort is enough to get over the line, it does require some genuine effort, but it is far from insurmountable.

For undergraduates of other topics, who wish to include some economics in their studies but without the numbers, political economy or economic history are worthy options. However, an economics major is sure to include a substantial amount of mathematics and statistics.

What are some reasons for studying

economics?

One of the main reasons to study economics is the practical knowledge that it will give you in terms of economic policy. If you have an interest in how our political elites manage the country, and how our media report it, you’ll find some economics knowledge of your own to be extremely illuminating!

An economics degree does not confine you to employment as an economist, it can lead to quite diverse career paths. Graduates may pursue work in finance, consulting, government, international organizations, academia, research, and many more fields of employment.

Economics encourages critical thinking and problem-solving. The discipline involves analyzing data, constructing models, and evaluating the implications of different policies, fostering analytical and logical reasoning. As well as helping you to understand how the world works and to gain certain types of jobs, the knowledge it gives you will help you to protect your personal finances.

What happens to my 401k if the economy

collapses?

If there is a severe economic collapse, it will almost certainly have significant implications for financial markets, including retirement accounts like 401(k)s. I have already alluded to the fact that the bond market is reaching a breaking-point, and that it would have serious consequences for pensions and savings plans.

Most, if not all, 401(k)s have put massive investment into long-dated government bonds, and if the government either defaults on its debt, or inflates it away via money-printing, it will greatly reduce the value of 401(k)s.

The way your 401(k) is allocated across different asset classes (stocks, bonds, cash, commodities) plays a crucial role. A well-diversified portfolio that includes assets with low correlation to each other will help mitigate losses during most economic downturns, because as one asset type falls, another should rise.

Many independent investors are turning to Bitcoin and Gold as alternative assets. This is due to their monetary properties at a time when the survival of the Fiat monetary system in the coming years is uncertain.

Sources:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.